Benefits of LLC in Illinois

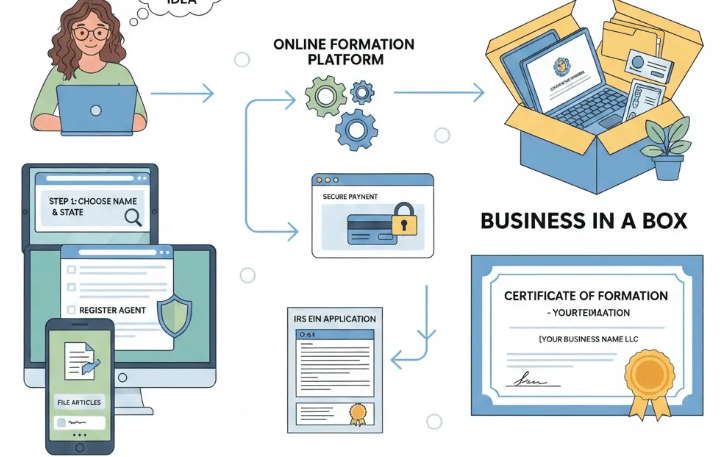

Advantages of LLC in Illinois – Liaibilty Protection Launch your business with an Illinois LLC and enjoy built-in asset protection, easy compliance, and tax perks designed to support long-term growth. In Illinois, forming an LLC comes with 5 key advantages. You get liability protection, tax flexibility, easy setup, flexible management, low costs, strong credibility, and …