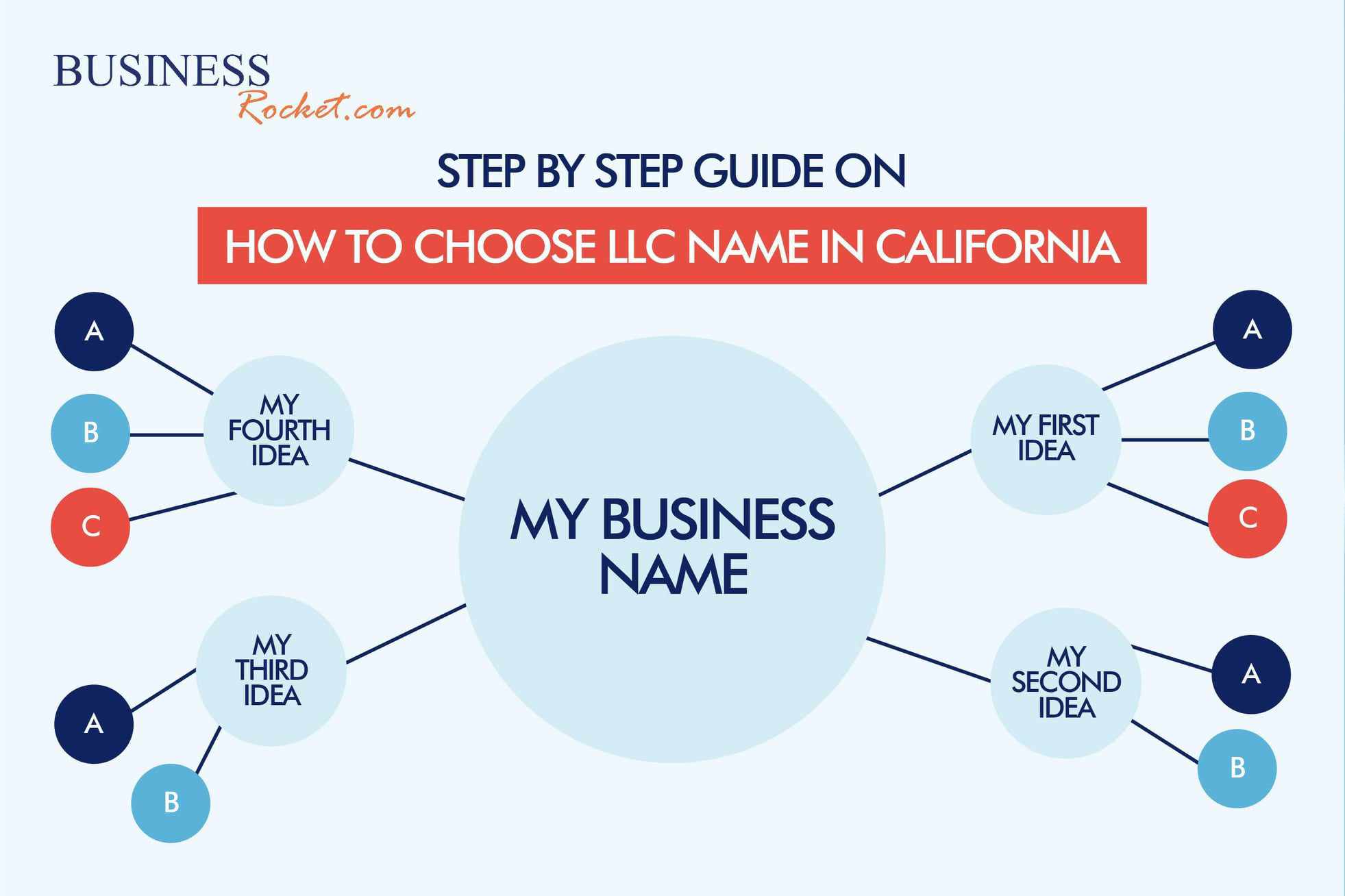

New Jersey Business Name Search (LLC lookup) in 2025

New Jersey Business Entity Search (LLC Lookup) Use https://www.njportal.com/, the official New Jersey Department of the Treasury site, to search and verify New Jersey LLC names for free. Register Your LLC Name Free REGISTER Your LLC Table of Contents New Jersey Business Entity Search in 2025 – Steps-by-Step Guide Open the NJ Business Name Search …

New Jersey Business Name Search (LLC lookup) in 2025 Read More »