California LLC Formation Services in 2026 – BusinessRocket

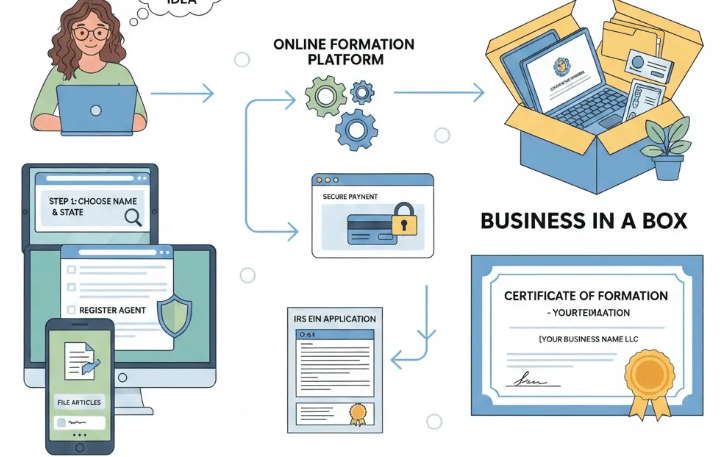

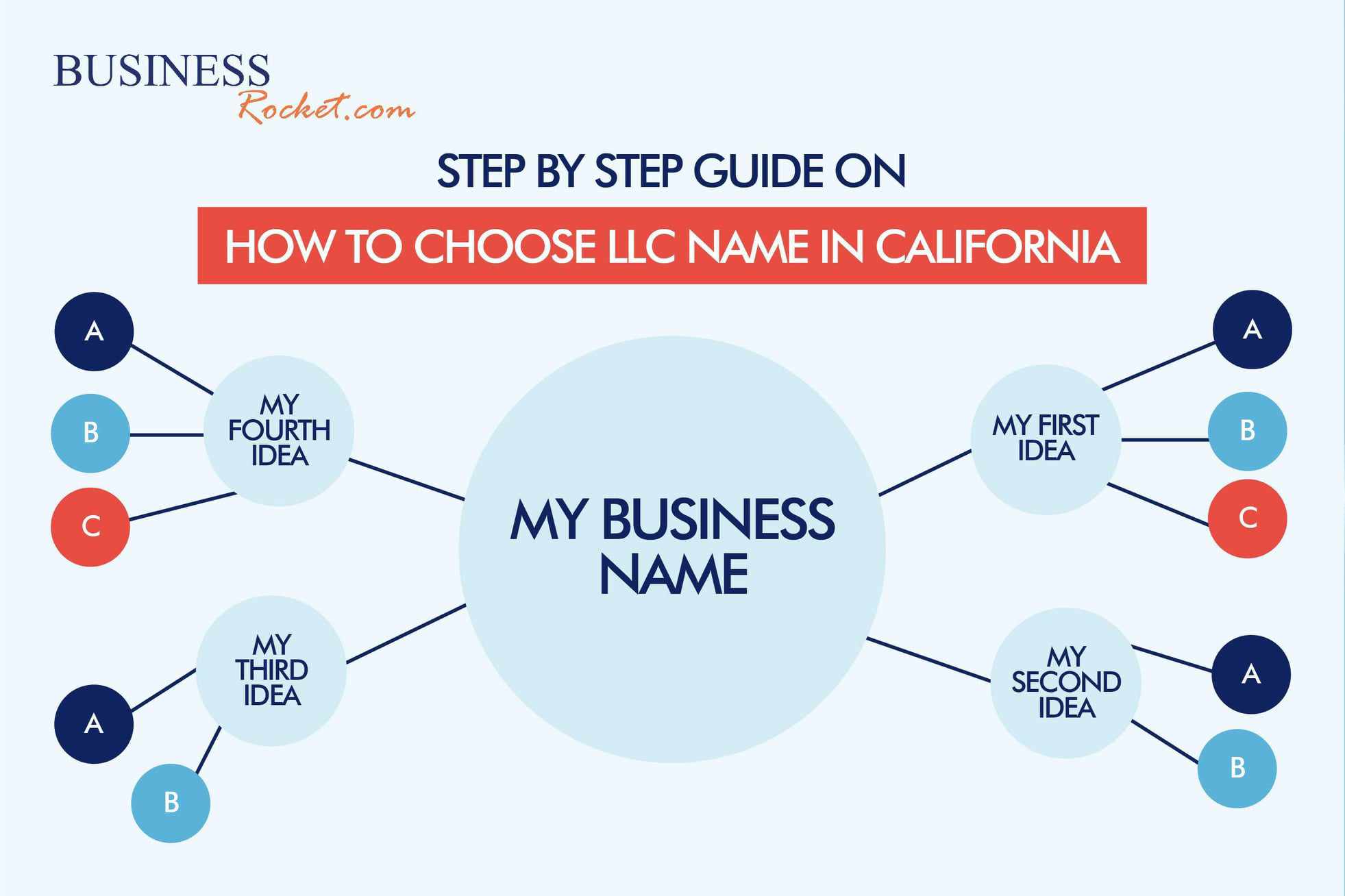

California LLC Formation Services in 2026 California LLC formation services help with registering your business quickly and managing the unique legal requirements of the state. Fastest National Processing Times! REGISTER AN LLC Table of Contents Top-Rated California LLC Formation Service California LLC Formation – Step-by-Step Guide Step 1: Name Your Business Step 2: Appoint a …

California LLC Formation Services in 2026 – BusinessRocket Read More »