LLC for Non-US Residents in 2025

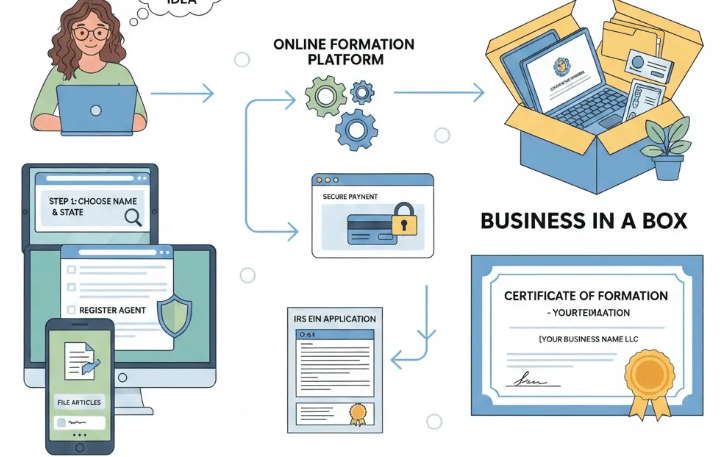

How To Open U.S. LLC for Non-US Residents In 2025 Yes, Non-U.S. residents are eligible to form a U.S. LLC. U.S. citizenship or residency is not required, nor is a Social Security Number (SSN) necessary to establish the LLC. The process is very similar for non-US residents and US residents, but there are a couple …