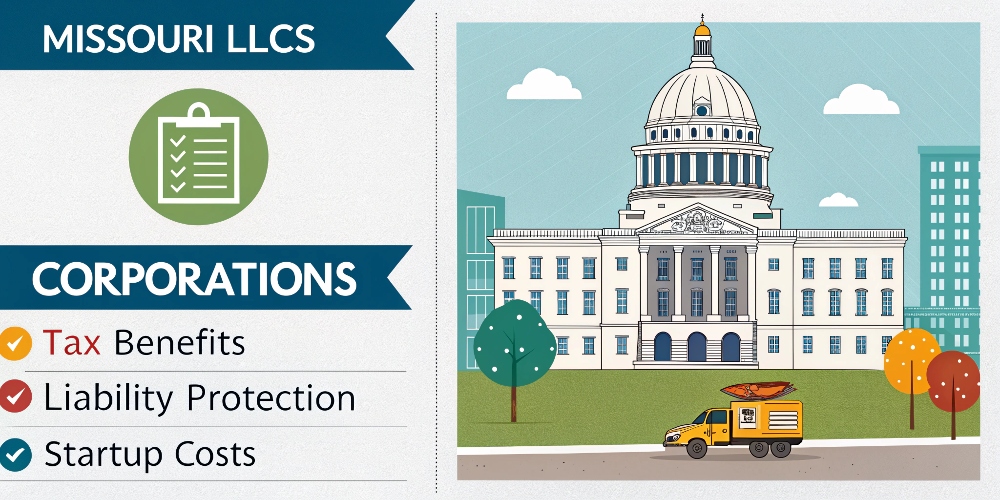

A Missouri LLC has lots of benefits. It gives you liability protection, tax savings, and low startup costs. No annual reports. Just $50 to file online. Flexible setup. Easy to manage. Perfect for small teams, solo owners, and side hustlers.

Forming a Limited Liability Company (LLC) in Missouri offers several significant advantages for business owners. Here are the key benefits:

Limited Liability Protection

Pass-Through Taxation

Flexible Management Structure

Fewer Formalities (No Annual Report/Fee)

Credibility

Flexible Profit Distribution

No Restrictions on Number of Owners

Why Are LLCs So Popular in Missouri?

In Missouri, LLCs are popular due to low filing fees and easy formation through the Missouri Secretary of State. Many prefer an LLC name over incorporation for lighter reporting and tax benefits.

Missouri’s business-friendly laws give LLC’s members flexibility and fewer formalities than a corporation in Missouri. This ease and protection make LLCs the top choice for many business owners.

Missouri LLCs vs Corporations: What’s the Better Fit for Your Business?

Starting a new business in Missouri? Choosing between an LLC or a Corporation matters. One’s flexible. The other’s more formal. Both offer liability protection, but the path is different.

LLC in Missouri (Chapter 347)

Easy to start. Few rules.

No board, no bylaws, no big meetings.

One tax. No double taxation.

Great for small teams, families, or side hustles.

File reports every other year.

Need a registered agent service.

Corporation in Missouri (Chapter 351)

Formal setup. Think boardrooms and bylaws.

Must hold meetings, take minutes, follow rules.

C Corps get taxed twice.

S Corp can skip that with IRS Form 2553.

Better for raising money or big growth plans.

File every year with the state of Missouri.

If you value flexibility, lower costs, and fewer annual duties, an LLC might be your answer. Remember, a Missouri LLC must meet fewer requirements than corporations. Now we discuss the advantages of forming an LLC today.

Key Advantages of Forming a Missouri LLC

Ready to launch your Missouri business with protection ? A Missouri LLC offers asset protection, tax efficiency, and operational flexibility, making it a top pick for entrepreneurs. With over 100,000 active LLCs in 2024, the Missouri Secretary of State keeps it simple, per Forbes.

A University of Missouri study shows LLCs save big on taxes and boost credibility. Here are seven advantages to power your small business in Kansas City, St. Louis, or beyond, each with a real-world example!

1. Asset Protection

A Missouri LLC shields your personal assets—home, car, savings—from business debts or lawsuits, per Missouri Revised Statutes (Chapter 347). This asset protection lets you grow your business entity without risking personal wealth.

Example: Ava, a St. Louis café owner, faced a $15,000 supplier lawsuit. Her LLC kept her home safe, so she kept brewing coffee.

2. Tax Efficiency

Enjoy pass-through taxation, where LLC profits flow to your tax return, taxed at Missouri’s 4–5.4% graduated rate (2025), per Missouri Department of Revenue. Skip corporate taxes and claim the Qualified Business Income (QBI) deduction (up to 20%, per IRS) for extra savings.

Example: Ethan, a Kansas City freelancer, saved $4,000 with QBI and bought new design software.

3. Operational Flexibility

Missouri LLCs offer flexible ownership—choose single-member or multi-member structures with member-managed or manager-managed setups, per Missouri Secretary of State. No need for corporate hoops, keeping operations smooth.

Example: Zoe, a Springfield marketer, picked member-managed, cut planning time by 20%, and landed two clients worth $10,000.

4. Business Credibility

Forming an LLC boosts credibility with clients, vendors, and banks, signaling a legit business entity. Open business bank accounts easily and land better contracts, per Missouri Division of Business Services.

Example: Liam, a Columbia retailer, formed an LLC and secured a $12,000 supplier deal his sole prop couldn’t.

5. Low Startup Costs

Start your Missouri LLC for just $50 (online Missouri Articles of Organization) or $105 (paper), per Missouri Secretary of State. Low fees make Missouri a budget-friendly choice for small businesses.

Example: Mia, a Branson event planner, filed online for $50 and opened her business bank account in days.

6. Minimal Annual Report

Missouri keeps compliance light with no annual report requirements for LLCs, per Missouri Revised Statutes. Update business details only when needed (e.g., registered agent changes), saving time and money.

Example: Noah, a Joplin consultant, skipped annual filings and saved $100/year, reinvesting in his website.

7. Ease of Management for Simplicity

Run your LLC without mandatory meetings or board approvals, per Missouri Secretary of State. An optional operating agreement simplifies decision-making, perfect for single-member or multi-member setups.

Example: Emma, a Cape Girardeau baker, used a simple operating agreement to streamline her single-member LLC, saving 10 hours/month on admin.

From asset protection to low startup costs, a Missouri LLC sets you up for success. File your Missouri Articles of Organization for $50 online and grow your small business with confidence!

The Tax Benefits of LLCs in Missouri Explained

Want to keep more cash? Missouri LLCs skip corporate taxes and slash self-employment tax with S-Corp smarts. A University of Missouri study shows LLCs save thousands, protecting personal assets. Here’s how Missouri LLCs cut your tax bill, per Missouri Department of Revenue (MODOR).

Pass-Through Taxation: No Corporate Tax

Missouri LLCs use pass-through taxation, with profits on your tax return at Missouri’s 4–5.4% graduated rate (2025), per MODOR. Single-member LLCs file Schedule C; multi-member LLCs use IRS Form 1065 and Schedule K-1.

The QBI deduction (up to 20%, per IRS) boosts savings.

No Franchise Tax: Keep More Profits

Unlike C-Corps, Missouri LLCs owe no franchise tax, per MODOR, freeing up cash for your business structure.

S-Corp Election: Slash Self-Employment Tax

Elect S-Corp status via IRS Form 2553 to cut self-employment tax (15.3% federal) for steady profits, per MODOR. Set up payroll to maximize savings.

Sales Tax: Only for Retail LLCs

Selling goods? Register for 4.225% + local sales tax via sos.mo.gov, per MODOR. Service-based LLCs often skip this.

Missouri Tax Credits: Extra Savings

Claim New Jobs Credit (up to $10,000 for hiring) or Small Business Incubator Credit, per MODOR, to power your small business.

File your Missouri LLC for $50 at sos.mo.gov to start saving and protect personal assets!

Is a Missouri LLC the Right Business Structure for Your Family and Your Business?

Family businesses thrive with a limited liability company in Missouri. It protects personal assets, allows flexible profit-sharing, and supports smooth estate planning. A smart choice for building lasting family wealth.

A Family LLC lets you stay in control. Use a solid operating agreement to set inheritance rules, voting rights, and who manages what.

When forming a business, you’ll need an EIN, choose your LLC structure, and follow state rules and regulations each year. Not personally liable. Whether from another state or local, it’s a strong legal entity to grow and protect your legacy.

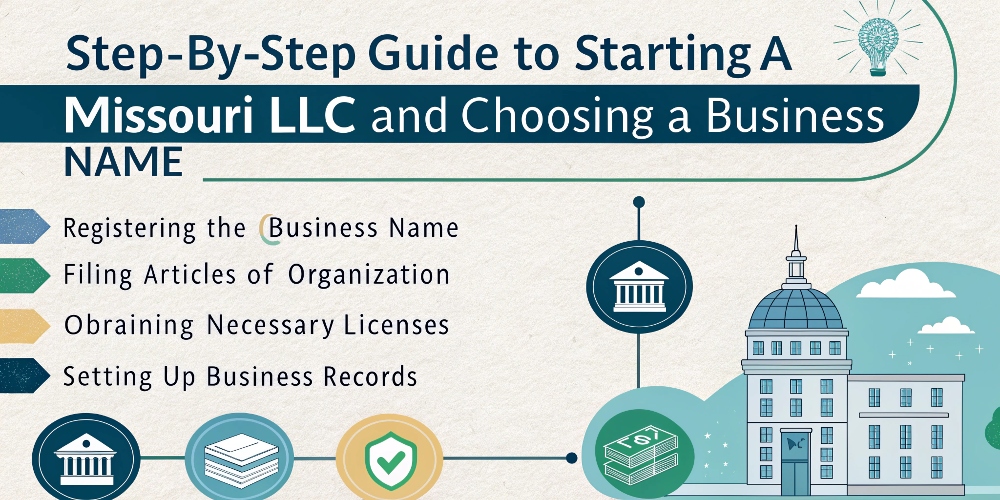

How To Form a LLC in Missouri – Step-by-Step Guide

Follow these simple steps to pick a business name and file via the Missouri Business Portal, per Missouri Revised Statutes .

Step 1: Choose a Unique Business Name

Pick a business name that follows Missouri naming rules.

Must include “LLC” or “Limited Liability Company”.

Do a name availability check on the Missouri Business Portal.

Reserve it for $25 (optional, 180 days).

Step 2: Appoint a Registered Agent

Choose a registered agent to receive legal documents.

Must be a Missouri resident or service with a physical address in Missouri.

Use a service ($100–$200/year) or be your own agent.

Step 3: File Articles of Organization

Submit the Articles of Organization (LLC-1 form) online for $50 via the Missouri Business Portal.

Include LLC purpose, registered agent, and address.

Approval takes 1–2 business days online.

Step 4: Create an Operating Agreement

Draft an operating agreement (optional but recommended).

Outlines management (member-managed or manager-managed).

Strengthens liability protection, per Missouri law.

Step 5: Get an EIN

Apply for a free EIN at IRS.gov for taxes and banking.

Required for most LLCs, even without employees.

Takes minutes online.

Step 6: Register for State Taxes

Sign up for state taxes via the Missouri Business Portal if selling goods (sales tax, 4.225% + local) or hiring (withholding tax).

Free Sales Tax License or Withholding Account, per Missouri Department of Revenue.

Step 7: Get Local Licenses

Check local business licenses with your city/county ($25–$100, e.g., $50 in St. Louis).

Some industries need state permits, per Missouri Division of Business Services.

What Is an Operating Agreement and How Does It Help Multiple Members?

A South Carolina limited liability company (LLC) runs smoother with an Operating Agreement. It’s the internal rulebook. For multi-member LLCs, this document defines who does what, who owns what, and how everything is shared. It keeps your business in sync at the state level—every year.

Here’s how it helps:

Defines ownership percentages

Sets clear voting rights

Splits profits/losses fairly

Assigns member responsibilities

Adds solid buy-sell provisions

A University of South Carolina study says it reduces disputes and boosts teamwork. Forming an LLC or picking a structure? This step matters. A strong foundation prevents problems. Use trusted legal help. Stay protected. Grow with confidence.

Missouri LLC Cost – Compliance, Formality, and State Rules

Starting a Missouri LLC is affordable and low-hassle. The Missouri Secretary of State doesn’t require annual reports or franchise taxes, making it easier to stay compliant.

Startup & Ongoing Costs

| Requirement | Startup Cost (One-Time) | Ongoing Cost |

|---|---|---|

| Articles of Organization | $50 (online) or $105 (paper) – [MO Business Portal] | None |

| Registered Agent | $0 (DIY) or $100–$200/year for a service | Same as startup if hired |

| Business License | $25–$100 (varies by city/county; $50 in St. Louis) | $25–$100/year – varies by location |

| Operating Agreement | $0 (self-made) or $100–$500 (legal/template) | None (optional but recommended) |

| EIN | Free at IRS.gov | None |

| Name Reservation | $25 (optional – holds name for 180 days) | None |

| State Taxes | $0 for LLC setup; sales tax (4.225% + local) if applicable | Ongoing sales/withholding tax (if needed) |

| CPA/Legal Help | $0–$500 (consultation/setup help) | $1,000–$3,000/year (optional) |

| Annual Reports | None required in Missouri | None |

Key Missouri State Rules

LLC Name must include “LLC” and be unique (check availability online).

Registered Agent must have a Missouri address and be available during business hours.

Articles of Organization (LLC-1 form) must be filed with the state.

Sales/Withholding Tax required if selling goods or hiring employees.

No Annual Meetings required—unlike corporations.

Operating Agreement is optional but useful for outlining structure.

Local Licenses required by city/county and industry (e.g., food, health).

Quick Example

Zoe, a Kansas City business owner, launched her LLC for $50 online. She pays $125/year for a registered agent, $50 for a local license, and uses a CPA at $1,500/year. Total startup cost: around $425.

You can form a Missouri LLC online for just $50 and maintain it with minimal red tape. It’s a smart, budget-friendly way to protect your business and enjoy various tax benefits.

When to Hire an Attorney or Law Firm for Help With Missouri LLCs

Forming an LLC in Missouri? Complex setups, like multi-member plans or foreign filings, can get tricky fast. Over 23% of businesses face compliance issues each state year . Business Rocket helps streamline the process, so you stay focused on growth.

The Missouri Bar Association notes that legal pros handle disputes, draft contracts, and protect assets.

If your LLC also requires help choosing between types of business entities, or switching to a corporation or LLC, expert support matters. With Business Rocket and a Missouri-based attorney, you avoid costly missteps at the state level.

What Every Entrepreneur Should Know About Missouri LLCs

Missouri LLCs offer liability protection, tax flexibility, and a smooth setup through the Secretary of State (business division). They’re a strong choice for navigating the state’s small business landscape.

Compared to a sole proprietorship, an LLC creates legal separation and potential tax advantages. Groups like local chambers of commerce, the IRS, and the Missouri Department of Revenue highlight the importance of staying compliant year-round.

Every business is different. Before filing, it’s smart to consult a tax professional or attorney to choose the right path and structure with confidence.

- Illinois Business Search in 2025 – Check Name Availability November 16, 2025 - Home » Benefits of an LLC in MissouriIllinois Business Entity Search in 2025 Visit www.ilsos.gov for Illinois business search to check the availability of an LLC name and other entity types, and enter your desired name in the search bar. Fastest National Processing Times! REGISTER AN LLC The Illinois Business Search is the state’s official …

Illinois Business Search in 2025 – Check Name Availability Read More »

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Benefits of an LLC in MissouriMaryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide …

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Benefits of an LLC in MissouriMaryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide …Maryland Business Name Search – Check Name Availability Read More »

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Benefits of an LLC in MissouriOhio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, …

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Benefits of an LLC in MissouriOhio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, …Ohio Business Entity Search – Check Name Availability Read More »