LLCs are a smart choice for rental property in 2025. They protect assets & lower tax burdens. Over 70% of new landlords form LLCs to manage risks & organize.

A study from the National Association of Realtors shows landlords with LLCs face fewer legal issues and enjoy smoother finances. It’s also easier to scale and manage your rentals under one setup.

In this quick guide, we’ll show how an LLC affects your taxes, liability, and profits—without the legal stuff. By the end, you’ll know when it’s a smart move… and when it’s just talk.

A report from the IRS shows that landlords using a single-member LLC can file a simple tax return while getting business-level protection. According to Forbes, an LLC helps with income tax, transfer tax, and makes property management easier for small landlords.

If you own investment property, an LLC may also let you write off more business expenses. You’ll only pay taxes on profits, not the full rental income. With the right insurance policy and even liability insurance, you’re more secure and more in control.

Is an LLC Good for Rental Property Owners?

Look, a rental property LLC can be awesome for landlords, but it’s not for everyone. I’ll break it down so you can decide if creating an LLC for rental property works for you.

If you’ve got one rental and good insurance, you might not need to use for my LLC. But if you’re growing a portfolio or want to keep things tidy, a LLC rental property is a total win.

When an LLC makes sense:

- You want to shield your personal assets from rental risks.

- You’re eyeing more than a couple of properties.

- You prefer business correspondence and money separate.

- Your state’s legal requirements make business formation easy.

When it might not be worth it:

- You’ve got one low-risk rental unit.

- Your state’s State LLC filing offices charge high fees.

- Lenders fuss about deed transfers for your LLC for rental property.

If rentals are your serious gig, create LLC for rental property to protect your assets and run it like a pro. Your business in the state stays safe and organized.

Why Landlords Choose an LLC for Rental Property

Many landlords move their rental property into an LLC to protect personal assets. An LLC draws a clear line between your property and personal liability, which lowers risk. Nearly 75% of real estate investors say the benefit of creating an LLC lies in its strong asset protection and legal separation.

- Keeps personal and rental finances separate

- Builds trust with lenders and tenants

- Makes it easier to form real estate partnerships

- Helps keep your LLC in good standing

- Allows you to name your LLC and open a bank account for your LLC

- Simplifies transferring a mortgaged property into the business

- Avoids mixing property as an individual with business assets

As Forbes notes, forming an LLC adds professionalism and security to your setup. You can transfer your rental property smoothly, hold the property deed under the name of the LLC, and treat your LLC like the business it is.

Pros and Cons of Using an LLC for Rental Property

Using an LLC for your rental isn’t just about formality it’s about smart protection. The advantages of an LLC include liability protection, so your personal assets stay safe. Plus, with pass-through taxation, income flows directly to you without double taxes.

Pros

Liability Protection: A LLC rental property shields your personal assets. Tenant lawsuits or property debts won’t hit your savings. It’s a top advantage of LLC.

Pass-Through Taxation: Your LLC for rental property avoids corporate taxes. Profits go to your Internal Revenue Service (IRS) personal return. This simplifies business correspondence.

Professional Credibility: A rental property LLC looks legit to tenants and vendors. It boosts your business in the state image. Clients trust your setup.

Flexible Management: You control how your LLC in the state runs. A simple operating agreement sets clear rules. It’s great for creating an LLC for rental property.

Asset Separation: Your LLC rental property keeps business and personal finances separate. This protects your LLC address privacy. It makes accounting easier.

Tax Deductions: You deduct property expenses like repairs or travel. The Internal Revenue Service (IRS) allows these for LLC tax benefits. It lowers your tax bill.

Scalability: A rental property LLC supports growth. Add properties under one LLC to streamline business formation. It’s ideal for expanding portfolios.

Cons

Filing Costs: Registering an LLC involves fees. State LLC filing offices may charge $50-$800 yearly. It’s an LLC downside for real estate.

Paperwork: Creating an LLC for rental property requires forms like operating agreements. Business correspondence takes time. It’s more work than a sole proprietorship.

Financing Challenges: Lenders may resist deed transfers for your LLC for rental property. This complicates loans. Check with banks early.

Public Disclosure Risk: State LLC filing offices may share your business address for LLC. This risks LLC public disclosure if using a home address as your business address.

Situational Considerations

If you own one low-risk rental, skip the LLC. Growing a portfolio or needing legal requirements met? Go for a rental property LLC. It’s a smart business structure comparison for serious landlords.

How an LLC Protects Your Personal Assets from Legal Risk

When you set up an LLC for a rental, you create a legal wall between your personal assets and your rental property under an LLC. This barrier—known as the corporate veil—protects your home, savings, and personal belongings if a tenant files a lawsuit or injury claim.

Here’s how it works in real situations:

- Only the property owned by the LLC is at risk

- Keeps property from liability claims and lawsuits

- Helps avoid exposing your personal assets in tenant disputes

- Keeps finances clean by separating personal and business expenses

- Lets you title to your LLC, boosting legal safety

But protection isn’t automatic. If you mix funds or skip formal steps, courts can pierce the veil. That’s why it’s vital to treat your LLC for real estate like a real business.

Name it right, open an account, and manage properly—even if you only have one rental property. The benefits of an LLC can easily outweigh the cons of creating an LLC when done right.

Tax Benefits of Using an LLC for Rental Income

Using an LLC for rental property can offer real tax advantages. It’s not just smart for asset protection, it can also help you save when it’s time to file your individual tax return. Whether you own one rental property or a growing portfolio, understanding your options matters.

Default Tax Treatment of LLCs

By default, an LLC for rental property uses pass-through taxation. That means rental income skips corporate taxes and goes straight to your individual tax return. It’s simple and avoids double taxation, which is ideal for most landlords.

Landlord Deductions and Write-Offs

With an LLC, you can deduct:

- Property tax

- Repairs and maintenance

- Travel related to rental management

- Business-related services or tools

These write-offs reduce taxable income and boost your cash flow. Just keep your property in an LLC and expenses well-documented.

S Corp Election Option

For active landlords, choosing S corp status could help cut self-employment taxes. It doesn’t work for every case — and requires strict IRS filings — but it can pay off for high-earning investors. Make sure to check with a tax pro to see if it fits your setup.

When an LLC Tax Strategy Makes Sense

If you’re just starting out, default LLC tax treatment may be enough. But if you’re growing, want more privacy, or are planning to set up a separate LLC for each property, consider these tax perks. A rental property under an LLC can do more than protect you — it can improve your bottom line.

Can You Transfer a Rental Property You Already Own into an LLC?

Yes, you can transfer your property to an LLC—even if you already own it. Nearly 1 in 3 real estate investors do this to separate rentals from personal assets. It involves a quitclaim deed, a title update, and possibly lender approval due to the due-on-sale clause.

According to Nolo, many business owners form LLCs to protect the value of your property and streamline taxes.

For example, Lisa in Arizona moved her duplex into an LLC to shield herself from tenant-related liability—and now runs each rental under an LLC with peace of mind.

Just set up the LLC, transfer the title, and notify your lender. If you haven’t yet purchased a rental property, consider forming the LLC first. It’s a smart step to protect your rental business and stay organized as a growing real estate investing pro.

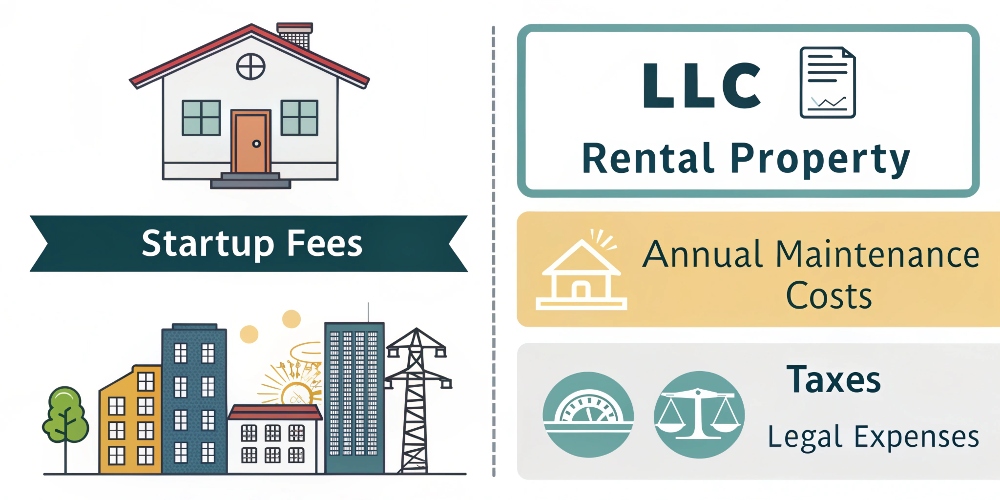

What Does It Cost to Create and Maintain an LLC for Rental Property?

Setting up a rental property LLC isn’t free, but it can save you headaches. I’ll break down the cost of LLC for create LLC for rental property so you know what to budget. The table below covers formation fees, ongoing compliance, and tax filings for your use for my LLC. Let’s make business formation clear.

Cost Type | Details | Examples |

|---|---|---|

State Filing Fees | One-time fee to register your LLC rental property with State LLC filing offices. | CA: $70; TX: $300; WY: $100; FL: $125. Varies by state ($40-$500). |

Annual Reports, Franchise Taxes | Yearly or biennial filings for ongoing compliance; some states charge franchise taxes. | CA: $800 franchise tax + $20 biennial report; TX: $0-$575 franchise tax (revenue-based); WY: $60 annual report. |

Hidden or Recurring Costs | Registered agent fees, licenses, or penalties for late business correspondence. | Registered agent: $100-$300/year; local permits: $50-$200; CA Form 568 penalties: $18+. |

What to Know

- Formation fees depend on State LLC filing offices; check your state for exact costs.

- Annual fees like franchise taxes or reports keep your LLC in the state compliant.

- Hidden costs like registered agent fees or Local zoning authority permits add up. Consider a virtual address for business for LLC address privacy.

Will You Need New Insurance When Using an LLC for Rental Property?

When you transfer a property to an LLC, your current insurance may no longer apply. That’s because an LLC is a business, not a person, so it needs its own coverage. Data from NAIC shows many landlords need to switch to commercial or landlord insurance after forming an LLC.

Update your rental property policy to reflect:

- List the LLC name as the insured party

- Switch to landlord or business liability coverage

- Consider an umbrella policy for extra protection

Once you buy the property or move rental properties into an LLC, don’t wait. Keeping the right policy in place helps you protect each property. Shield the owners of an LLC and separate the property from your personal assets, with peace of mind built in.

Best (and Worst) States for Rental Property LLCs

Picking the best state for rental LLC can boost your rental property LLC. I’ll help you find where to create LLC for rental property based on LLC laws by state. Let’s make business formation simple.

State | Landlord-Friendly Rating | Key Details |

|---|---|---|

Wyoming | Best | Low cost of LLC: $100 filing, $60 annual fees. No state income tax. |

Texas | Best | $300 filing, no income tax. Fast evictions for LLC rental property. |

Delaware | Good | $90 filing, $300 annual fees. Strong privacy for rental property LLC. |

California | Worst | High California rental LLC costs: $800 franchise tax. Strict tenant laws. |

Vermont | Worst | High taxes (1.83%); slow evictions hurt LLC in the state. |

What to Know

- Wyoming and Texas are top for low annual fees and landlord-friendly local rental laws.

- California and Vermont have high cost of LLC and tough landlord laws.

- Check State LLC filing offices for business correspondence and legal requirements.

Should You Form an LLC for Your Rental Property in 2025?

Using an LLC for a rental property gives you a legal buffer between your assets and liability. If you’re the owner of the property, this structure helps separate personal and rental finances. In 2025, many landlords are choosing to treat their rentals like a business entity, especially when managing multiple properties.

Quick checklist to help you decide:

- Do you own one property or plan to scale to multiple properties?

- Are you the sole member of the LLC, or sharing ownership?

- Can you handle the costs associated with creating an LLC and maintaining it?

If you’re managing rental properties in an LLC, it may make sense to use a separate LLC for each rental. While there are some cons of an LLC, like added filings, the legal protection often outweighs the hassle. So, if you need an LLC to safeguard your investment, forming an LLC for rental might be your smartest move.

FAQs

What are the benefits of creating an LLC for a rental property?

An LLC for rental property keeps your personal assets safe from lawsuits. You get a pass-through tax for real estate tax benefits with the Internal Revenue Service (IRS). It separates business correspondence from personal finances. It’s a pro move for your use for my LLC.

What are the cons of creating an LLC for a rental property?

LLC downsides for real estate include fees from State LLC filing offices. You’ll deal with extra paperwork for creating an LLC for rental property. Mortgage transfers can be tough. It’s not always best for low-risk rentals.

Do I still need liability insurance if I use a limited liability company?

Yup, you need insurance for your LLC rental property. An LLC protects personal assets, but insurance covers tenant injuries or property damage. Both are key for risk analysis. Don’t skip either.

Can I transfer property to an LLC without triggering income tax issues?

You might face taxes when moving property to a rental property LLC, especially with a mortgage. Taxation types can get tricky with the Internal Revenue Service (IRS). Talk to a tax pro for your business in the state. It saves headaches.

Is it worth it to create an LLC for a single rental property?

If your rental has high risk, an LLC for rental property is worth it. For small, low-risk units, insurance might do the trick. Balance the cost of LLC with the advantages of LLC for your business formation.

How does income tax work when owning rental property through an LLC?

Your LLC rental property gets pass-through tax, hitting your personal Internal Revenue Service (IRS) return. You can deduct repairs or mortgage interest for real estate tax benefits. It keeps business correspondence simple. No separate business tax unless you choose an S corp.

Can I get financing if I form an LLC for my rental business?

It’s tougher with a rental property LLC. Some lenders prefer individuals over LLCs. Buy in your name, then transfer to your use for my LLC, or find LLC-friendly loans. Check business correspondence with banks.

What are the advantages of an LLC versus owning rental property in your name?

An LLC for rental property limits liability, unlike personal ownership. It organizes finances and adds credibility for business formation. It’s great for portfolios or partners. Advantages of LLC keep your rentals professional.

What is the biggest risk of moving a mortgaged rental property to an LLC?

The “due-on-sale” clause is the main worry for your LLC rental property. Lenders might demand full loan repayment if you transfer without approval. Get the lender okay before creating an LLC for a rental property. It’s critical for risk analysis.

Should I use separate LLCs for each rental property I own?

Separate LLCs isolate risk for your rental property LLC. One property’s lawsuit won’t hit others, a big advantage of an LLC. But more LLCs mean a higher cost of LLC and paperwork. It’s a business structure comparison for portfolio owners.

- Illinois Business Search in 2025 – Check Name Availability November 16, 2025 - Home » Is LLC Good For Rental Property in 2025Illinois Business Entity Search in 2025 Visit www.ilsos.gov for Illinois business search to check the availability of an LLC name and other entity types, and enter your desired name in the search bar. Fastest National Processing Times! REGISTER AN LLC The Illinois Business Search is the …

Illinois Business Search in 2025 – Check Name Availability Read More »

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Is LLC Good For Rental Property in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search …

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Is LLC Good For Rental Property in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search …Maryland Business Name Search – Check Name Availability Read More »

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Is LLC Good For Rental Property in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, …

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Is LLC Good For Rental Property in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, …Ohio Business Entity Search – Check Name Availability Read More »