Embarking on the journey to secure a TCP license involves a critical step: ensuring you have the right commercial insurance in place, as mandated by the CPUC. To get an active TCP license from the CPUC, you need to have commercial insurance that’s already e-filed with them. When it comes to your TCP license, insurance is your key. Therefore, it is crucial to know what the CPUC requires for your commercial insurance before you apply. Your insurance should cover you well against any personal liability and damage to property.

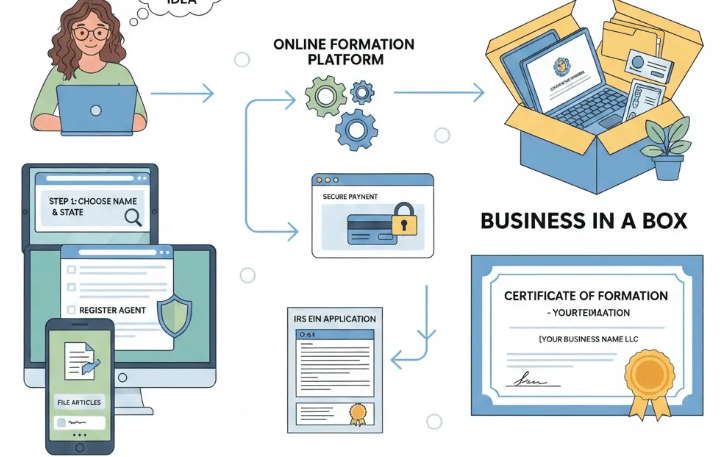

To make the process of meeting the TCP insurance requirements seamless, you may need the expertise of professionals. So, teaming up with BusinessRocket is the best way to ensure that you have all the correct information to start shopping for a commercial insurance policy.

Minimum Liability Requirements

The minimum liability amount required on the policy varies. It all depends on the type of TCP license you have and how many people your vehicle can carry, including the driver. Let’s have a closer look at these requirements:

- For those operating with a TCP license type C, the law says you need at least $750,000 in liability coverage. This particular license, type C, does not base the insurance coverage on the seating capacity of the vehicle.

- In other cases, the number of seats matters. If your vehicle can take up to 7 passengers, including the driver, you also need a minimum of $750,000 in coverage.

- For vehicles that can carry 8 to 15 passengers, including the driver, the minimum liability jumps to $1,500,000 on the insurance policy.

- Lastly, a vehicle with a seating capacity of 16 passengers or more, including the driver, must have a minimum liability of $5,000,000 on the insurance policy. It is important to know these TCP license requirements as CPUC will not issue an active TCP if the minimum liabilities are not met, regardless of whether the policy has been e-filed.

Partnering with BusinessRocket for Comprehensive Support

Working with the right insurance agent can make a big difference, especially when it comes to meeting TCP insurance requirements and handling the CPUC’s online filing system effectively. Your agent can help you get different quotes from various insurance companies and make sure your policy is officially filed online with the CPUC. As per the regulations of CPUC, you need to bind a policy with an insurance company that is authorized to complete state-level e-filings rather than provide any paper certificates showing proof of insurance. This makes the importance of insurance agents pretty clear.

When it comes to business guidance and expert advice on TCP license requirements, BusinessRocket can be your helping hand. Apart from assisting you with completing and submitting the TCP application, we will also refer you to an insurance agent who will assist you with obtaining the correct commercial insurance policy.

TCP License: What are the drug testing requirements for the TCP license? March 22, 2024 - Home » TCP License: Insurance Requirements – Complete Guide TCP License: What are the drug testing requirements for the TCP license Before approving a TCP license, the CPUC mandates that all drivers applying for a TCP license first complete drug testing. Every driver on the list must enroll in a Drug and Alcohol Program that …

TCP License: What are the drug testing requirements for the TCP license? March 22, 2024 - Home » TCP License: Insurance Requirements – Complete Guide TCP License: What are the drug testing requirements for the TCP license Before approving a TCP license, the CPUC mandates that all drivers applying for a TCP license first complete drug testing. Every driver on the list must enroll in a Drug and Alcohol Program that …TCP License: What are the drug testing requirements for the TCP license? Read More »

TCP License: Identifying the Different TCP License Types January 29, 2024 - Home » TCP License: Insurance Requirements – Complete Guide TCP License: Identifying the Different License Types What is a TCP license type? “Transportation Charter Party” or TCP, is a license required for any company that operates charter vehicles in the state of California. When applying for a TCP license you are required to select the …

TCP License: Identifying the Different TCP License Types January 29, 2024 - Home » TCP License: Insurance Requirements – Complete Guide TCP License: Identifying the Different License Types What is a TCP license type? “Transportation Charter Party” or TCP, is a license required for any company that operates charter vehicles in the state of California. When applying for a TCP license you are required to select the …TCP License: Identifying the Different TCP License Types Read More »

California TCP License – Vehicle Requirements December 27, 2023 - Home » TCP License: Insurance Requirements – Complete Guide California TCP License – Vehicle Requirements The type of vehicle that can be added to a TCP license is not subject to any specific requirements. One thing that is required is that vehicles on the TCP license should have a commercial registration. The CPUC will allow …

California TCP License – Vehicle Requirements December 27, 2023 - Home » TCP License: Insurance Requirements – Complete Guide California TCP License – Vehicle Requirements The type of vehicle that can be added to a TCP license is not subject to any specific requirements. One thing that is required is that vehicles on the TCP license should have a commercial registration. The CPUC will allow …