When it comes to forming a cheap LLC, the choices can be overwhelming. You may find a pool of service providers offering LLC registration at various prices, but how do you know which option is best for you if you are creating a Cheap LLC? Therefore, it is important to navigate this landscape with a clear head. What really matters is not just the initial cost but also what you get for your money. Are you receiving essential legal documentation or just the bare minimum? Does the service include personalized advice, or is it a one-size-fits-all approach? A proper insight into all these aspects can help you make a rational choice, ensuring that your ‘Cheap LLC’ doesn’t end up costing you more in the long run. In the following section, we will discuss all the requirements for creating an LLC in a budget-friendly manner.

Step 1: What Do I Actually Need For Getting a Cheap LLC

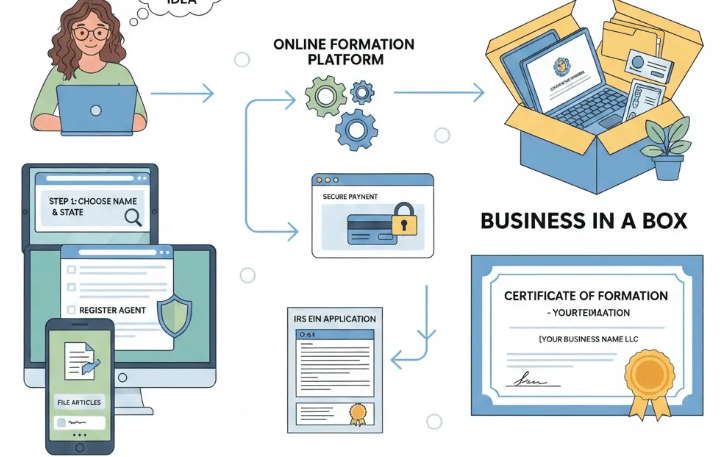

Before looking at the price, it is essential to understand what you actually need when forming an LLC. Simply registering an LLC with the state is not enough. It is only the first step towards creating a shell of your company. To build the real structure, your new LLC should have the following critical elements:

- Articles of Organization: These documents act as your business’s birth certificate. They legally establish your company in your chosen state. Without this document, your business is just an idea, not a legal entity.

- EIN number: This is the number issued by the IRS to your business. It allows your business to conduct financial transactions with banks and vendors. Akin to the Social Security number for individuals, the EIN number is for the business itself.

- Operating Agreement: Your LLC might be officially formed, but it needs rules and structure. The Operating Agreement is where you define how your LLC operates, who owns what, and how decisions are made. It’s a blueprint that outlines the internal workings of your business, providing clarity and stability.

- Organizational Minutes: These are the official records of your LLC’s first meeting. While an LLC doesn’t need as many formal meetings as a corporation, this initial meeting is crucial. It’s where you ratify the Operating Agreement and establish the initial structure of your company.

- Bank Resolutions: When it comes time to open a bank account for your business, banks are required to see the ownership of your company. Here, bank resolution plays its part. Unlike the operating agreement, which is usually over 30 pages long, a bank resolution is a concise document. This document is normally a short one-page page that outlines the important points that the bank may require prior to opening your business bank account.

Step 2: Beware of Hidden Fees

When venturing into the process of setting up a Cheap LLC, it’s crucial to be aware of the pricing structure and potential hidden costs. Many companies in the market offer appealing “Free Packages,” but it’s wise to tread carefully. These seemingly attractive deals often come with hidden annual renewal fees or mandatory subscription services that can quickly inflate costs. The key is to select a vendor that offers transparency and puts you in charge of your business without any unexpected financial surprises.

Secure the Best Deal on Your LLC With Business Rocket

Setting up an LLC does not have to be a costly affair filled with hidden fees and complex procedures. At Business Rocket, we offer the most competitive prices in the industry, preventing clients from the expensive and complicated process of establishing a business. Our Essential package is discounted from $195 to $147 and covers all the necessary components for creating a Cheap LLC. The best part about our package is that it is a one-time payment with no annual fees. Our company goes by the motto: if you need us for something else, we are always here for you. We provide our clients with the ability to file their own reports without having to incur annual service fees. Unlike other competitors who charge upwards of $199 per year for this service, you can reap the benefits of our services with no additional fees; connect with us at Businessrocket.com.

Maryland LLC Formation Services in 2026 February 12, 2026 - Home » Cheap LLC: What is needed when Creating an LLCTop LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast for …

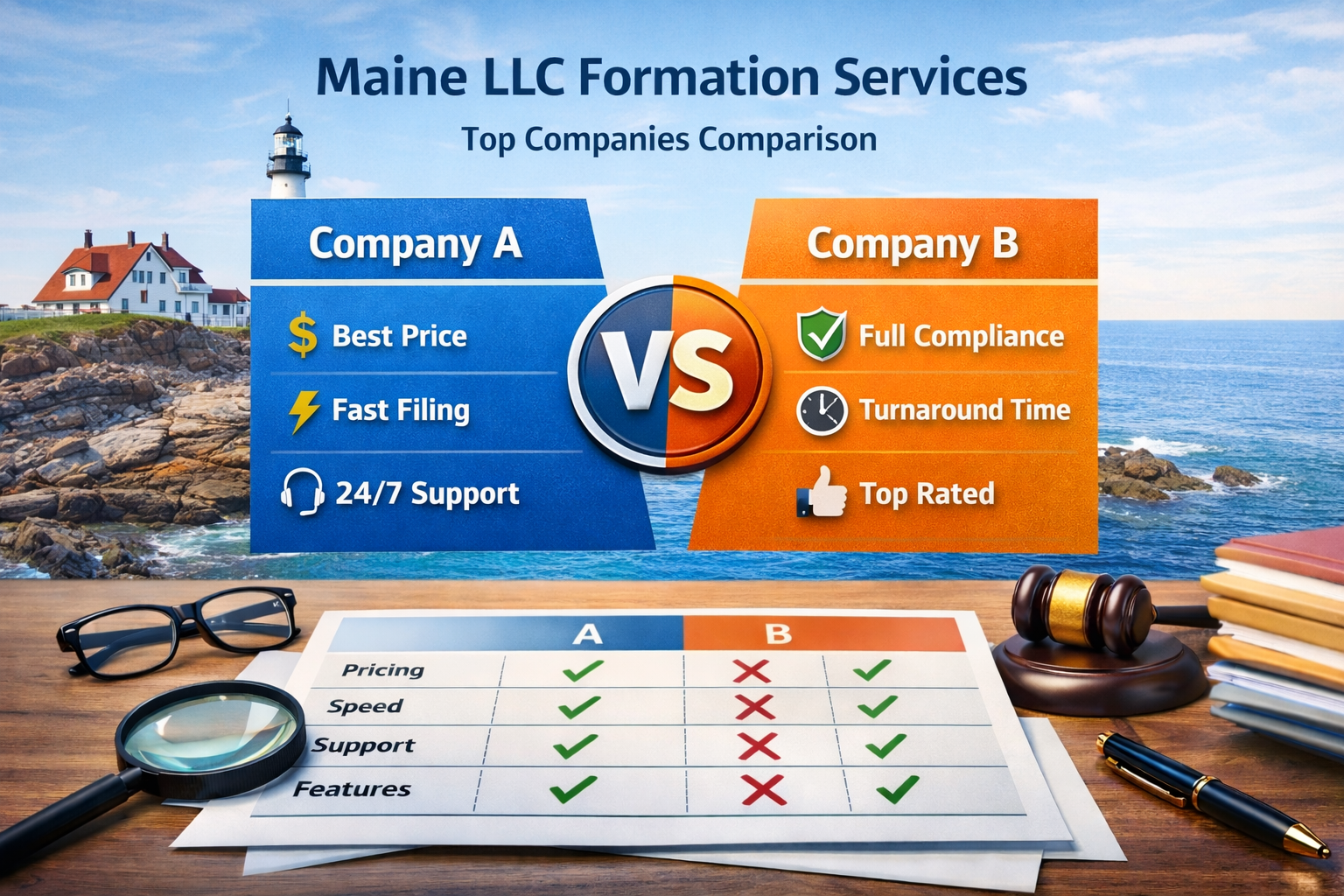

Maryland LLC Formation Services in 2026 February 12, 2026 - Home » Cheap LLC: What is needed when Creating an LLCTop LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast for … Maine LLC Formation Services – Start Your LLC February 9, 2026 - Home » Cheap LLC: What is needed when Creating an LLCLLC Formation Maine – Top Companies Services Comparison In 2026, Maine LLC formation services matter more than ever. With most new businesses choosing LLCs, Maine offers founders a simple, flexible start. Fast and Secure Business Packages REGISTER AN LLC In 2026, maine LLC formation services …

Maine LLC Formation Services – Start Your LLC February 9, 2026 - Home » Cheap LLC: What is needed when Creating an LLCLLC Formation Maine – Top Companies Services Comparison In 2026, Maine LLC formation services matter more than ever. With most new businesses choosing LLCs, Maine offers founders a simple, flexible start. Fast and Secure Business Packages REGISTER AN LLC In 2026, maine LLC formation services … New York LLC Formation Services – Best and Fast February 9, 2026 - Home » Cheap LLC: What is needed when Creating an LLCLLC Formation New York – Best Companies Services Comparison LLC formation New York services compared side by side. Compare top companies, pricing, features, pros and cons, and choose the best option to start your NY LLC fast. Fast and Secure Business Packages REGISTER AN LLC …

New York LLC Formation Services – Best and Fast February 9, 2026 - Home » Cheap LLC: What is needed when Creating an LLCLLC Formation New York – Best Companies Services Comparison LLC formation New York services compared side by side. Compare top companies, pricing, features, pros and cons, and choose the best option to start your NY LLC fast. Fast and Secure Business Packages REGISTER AN LLC …