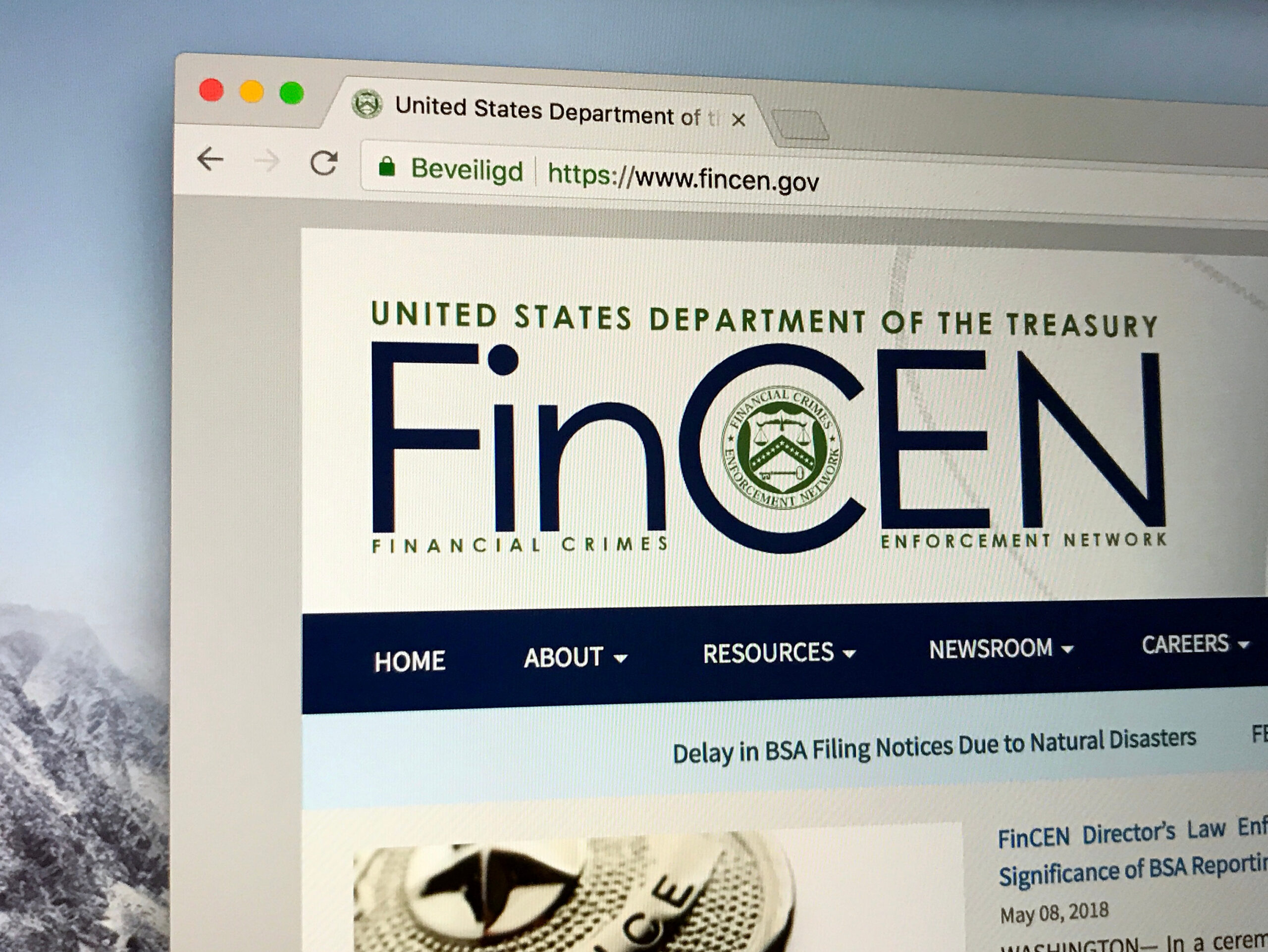

The BOI Report is the latest beneficial ownership information report being administered by the Federal government, specifically the Financial Crimes Enforcement Network (“FinCEN”). All newly registered and currently operating businesses in the US are obliged to file this report. A small number of companies are exempt from making the report, yet even those entities must submit the initial report to FinCEN informing them of their exemption.

When Is The BOI Report Due?

The requirements for filing this report vary depending on the date that your business was founded:

Companies established AFTER January 1st, 2024

Organizations established AFTER January 1st, 2024, will have 90 days to file the report.

Companies established Before December 31st, 2023

Organizations established BEFORE December 31st, 2023, will have until the end of 2024 to file this report. Thus, the deadline is December 31st, 2024.

What are the BOI Penalties for Failure to File the Report?

Companies that fail to file the report might face fines of up to $500 every day, according to FinCEN. In order to prevent ongoing fines from the government, it is necessary that this report be submitted on time.

Why Was The BOI Report Implemented?

The federal government brought the BOI (beneficial ownership information) report into effect to make sure that all United States-based entities disclosed their ownership information to the federal government. By providing this report to the federal government, the government can easily determine who owns each company.

The government can now quickly ascertain which organization an individual belongs to in case they are under surveillance. The government is also interested in figuring out if the people living in sanctioned countries have ownership in US-based businesses.

With a BOI Report, the government will find it easier to identify which corporations are impacted by new sanctions imposed on nations like North Korea, Russia, or other sanctioned nations on the US list.

How to File the BOI Report?

To manage all BOI reporting requirements, BusinessRocket has created a whole new department for our clients. Our team is in charge of how to submit a BOI Report and is available to answer any inquiries throughout business hours. You can reach us by:

Submit BOI Request by Email: You can get started on your report by emailing BuisnessRocket at Sales@BusinessRocket.com. Just make sure to provide your organization’s name, the state in which it was established, and your preferred phone number for a follow-up call.

Submit BOI Request by Phone: Dial 888-700-8213 for BusinessRocket and select Extension 1 for our onboarding team. They will let you know about your next steps for your report in detail.

How Much Does It Cost To File The BOI Report?

The fee for BusinessRocket’s BOI Report service is only $99. It is a great deal, considering it covers all filing and processing costs of the report. There are also no extra costs by the government to submit this report.

LLC North Carolina Services - Home » What is the BOI Report? How do I submit it?North Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC North carolina llc formation services are …

LLC North Carolina Services - Home » What is the BOI Report? How do I submit it?North Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC North carolina llc formation services are … Top Florida LLC Formation Services in 2026 - Home » What is the BOI Report? How do I submit it?Top Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of …

Top Florida LLC Formation Services in 2026 - Home » What is the BOI Report? How do I submit it?Top Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of … Maryland LLC Formation Services in 2026 - Home » What is the BOI Report? How do I submit it?Top LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast …

Maryland LLC Formation Services in 2026 - Home » What is the BOI Report? How do I submit it?Top LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast …