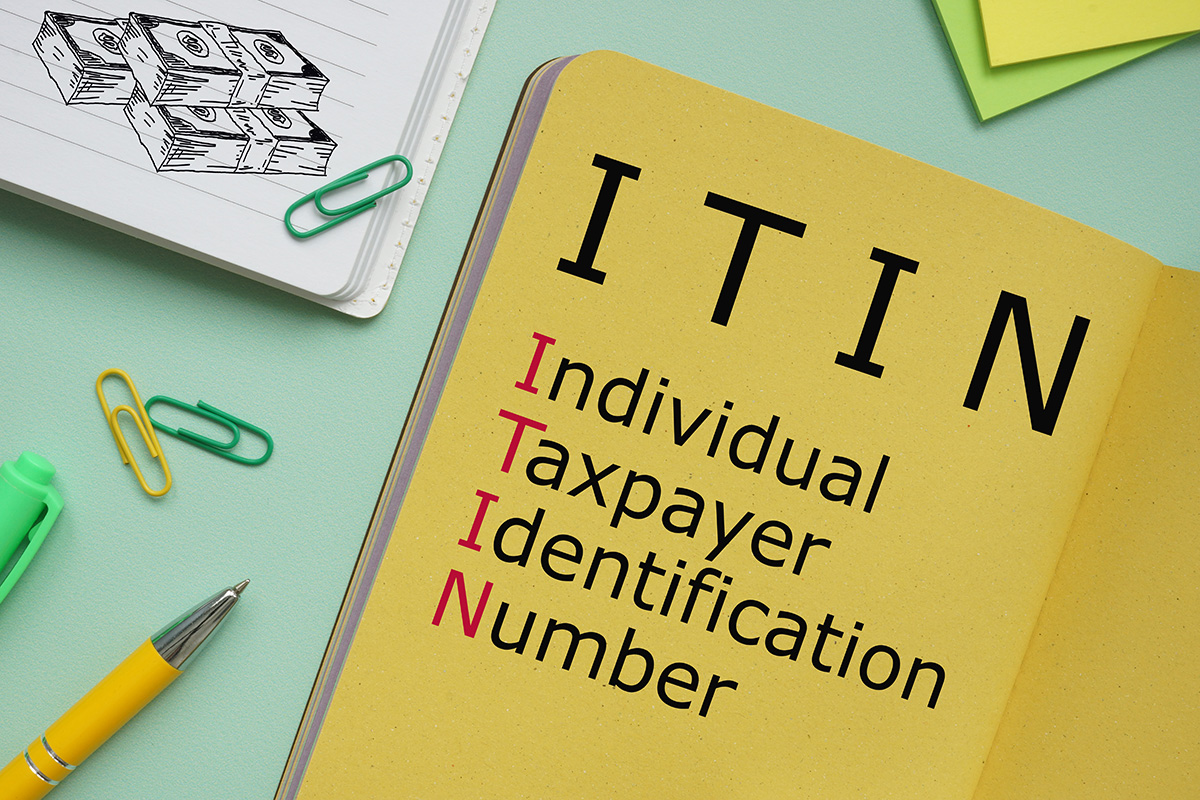

ITIN is officially known as the Individual Taxpayer Identification Number, a unique identification number issued by the Internal Revenue Service (IRS). It is specifically designed for individuals who do not have and are not eligible to obtain a Social Security Number, but still need to comply with U.S. tax laws.

What is an ITIN used for?

The primary purpose of an ITIN is to enable individuals to account for tax returns and payments, ensuring compliance with the tax requirements set forth by the IRS. It serves as a means for individuals to fulfill their tax obligations and report their income accurately.

It’s worth mentioning that ITINs do not serve any purpose other than federal tax reporting. They are not valid for work authorization, eligibility for Social Security benefits, or any other federal benefits.It’s important to note that an ITIN is issued regardless of an individual’s current immigration status.

Do you need an ITIN?

Are the following points applicable to you?

You do not have and are not eligible to obtain a Social Security Number (SSN).

You have a requirement to file a U.S. federal tax return or need to comply with U.S. tax laws.

You do not qualify for any other type of taxpayer identification number.

You need an identification number for federal tax reporting purposes but not for work authorization or federal benefits.

You are in one of the following:

You are a non-U.S. citizen or resident alien.

You are a dependent or spouse of a U.S. citizen or resident alien and need to be claimed on their tax return.

Nonresident alien claiming a tax treaty benefit

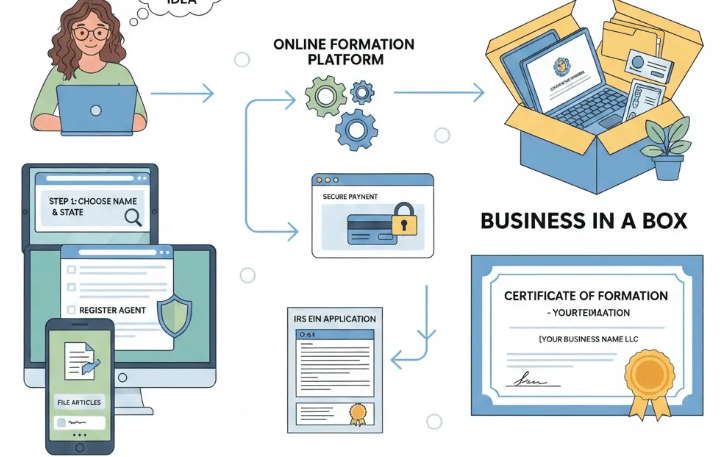

To apply for an ITIN, you need to complete Form W-7, the Application for IRS Individual Taxpayer Identification Number. This form requires you to provide supporting documents to verify your identity and foreign status. These documents may include your passport, visa, or other identification issued by your country of residence.

Conclusion:

It’s essential to note that the application process for an ITIN can be complex, and the supporting documentation requirements may vary depending on your situation. To ensure a smooth and successful application, it is highly recommended to seek professional assistance such as BusinessRocket. Their team of professionals can provide guidance and support to help you navigate the complexities of obtaining an ITIN and ensure compliance with U.S. tax laws.

Utah Business Search in 2026 – Check Name Availability March 8, 2026 - Home » What is an ITIN? Do I need one?Utah Business Entity Search in 2026 Utah Business Entity Search is an online tool that allows users to find business names and information about companies registered in the Utah state database. Fastest National Processing Times! REGISTER AN LLC The search tool is managed by the Utah …

Utah Business Search in 2026 – Check Name Availability March 8, 2026 - Home » What is an ITIN? Do I need one?Utah Business Entity Search in 2026 Utah Business Entity Search is an online tool that allows users to find business names and information about companies registered in the Utah state database. Fastest National Processing Times! REGISTER AN LLC The search tool is managed by the Utah …Utah Business Search in 2026 – Check Name Availability Read More »

Kentucky LLC Formation Services March 1, 2026 - Home » What is an ITIN? Do I need one?Kentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the …

Kentucky LLC Formation Services March 1, 2026 - Home » What is an ITIN? Do I need one?Kentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the … LLC North Carolina Services Provider February 27, 2026 - Home » What is an ITIN? Do I need one?North Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong …

LLC North Carolina Services Provider February 27, 2026 - Home » What is an ITIN? Do I need one?North Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong …