Starting a business can be complex, especially when it comes to navigating legal requirements. Two terms that often cause confusion for new entrepreneurs are “Limited Liability Company (LLC)” and “Business License.”

A business license is not the same as registering an LLC. They both have separate purposes and are individually beneficial for your business. This article uncovers everything you need to know about registering an LLC or having a business license.

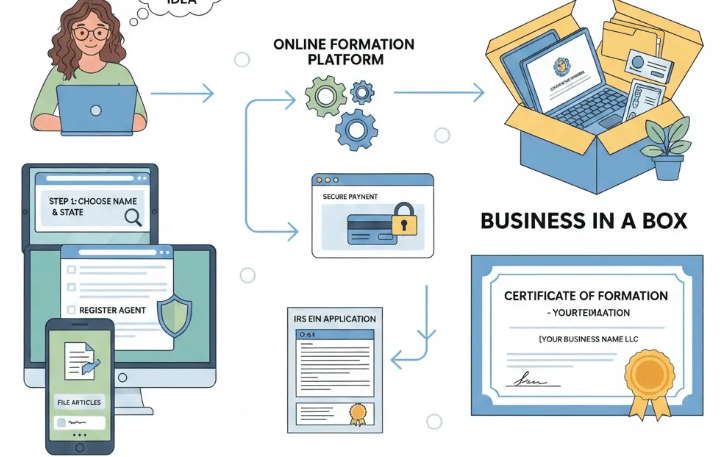

You focus on growth. We’ll handle your LLC & Business License formation.

Building a business is enough work as it is. BusinessRocket can help you turn a great idea into your greatest success.

What is Limited Liability Company (LLC)?

An LLC is a popular business structure known for its liability protection and pass-through taxation. It limits the personal liability of the owners (or “members”) for business debts and obligations and provides certain tax advantages. Limited liability companies are types of legal business entities that combine elements of a corporation and a partnership or sole proprietorship.

It is a popular choice for small and medium-sized businesses due to its flexibility and liability protection. There are many different business structures: Corporations, Sole-Proprietorships, Partnerships, Non-Profits, and Limited Liability Companies. Every business structure is special to the sort of association you intend to begin.

What is a Business License?

Unlike an LLC, a business license is not a business structure, it is a legal requirement for conducting business operations within a particular location. In other words, it is a permit that is issued to the underlying business structure by your local municipality that allows you to operate your business legally in any state. It can issue at the federal, state, or local level depending on the location and industry you operate in.

The purpose of a business license is to ensure that businesses comply with local regulations, safety standards, and zoning requirements.

Differences between an LLC and a Business License?

An LLC is a legal business structure that allows for the conduction of financial transactions. It offers a formal framework for organizing the ownership, management, and operation of the business.

On the other hand, a business license does not determine the legal structure of the business. It is an authorization to engage in specific business activities within a jurisdiction but does not define how the business should be structured or operated.

The bottom line:

To conclude, an LLC is a business structure that allows you to start conducting business transactions, but certain types of business transactions will require you to obtain additional business licenses or permits from your local municipalities.

By adhering to these requirements and taking the necessary steps to remain compliant, you can protect your entrepreneurial journey from unnecessary legal obstacles.

If you’re planning to start a business and need guidance on forming an LLC and obtaining a business license, consider reaching out to BusinessRocket. Our team of experts can help you with the legal requirements and provide you with a hassle-free experience.

Kentucky LLC Formation Services March 1, 2026 - Home » Difference between an LLC and a Business LicenseKentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the …

Kentucky LLC Formation Services March 1, 2026 - Home » Difference between an LLC and a Business LicenseKentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the … LLC North Carolina Services Provider February 27, 2026 - Home » Difference between an LLC and a Business LicenseNorth Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong …

LLC North Carolina Services Provider February 27, 2026 - Home » Difference between an LLC and a Business LicenseNorth Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong … Top Florida LLC Formation Services in 2026 February 16, 2026 - Home » Difference between an LLC and a Business LicenseTop Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of the fastest-growing …

Top Florida LLC Formation Services in 2026 February 16, 2026 - Home » Difference between an LLC and a Business LicenseTop Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of the fastest-growing …