Home » In-State vs. Delaware: Where Should You Establish Your LLC

Deciding where to form your Limited Liability Company (LLC) is an important consideration when starting a business. Among the multiple choices, Delaware is often seen as a favorable state for LLC formation due to its business-friendly environment and well-established legal framework. However, before making this decision there are various factors to evaluate.

This article explores the advantages and considerations of forming an LLC in Delaware versus forming it in the state where you reside.

Forming your LLC in Delaware:

Delaware is widely recognized as one of the most popular states for forming a limited liability company (LLC). Many entrepreneurs are attracted to Delaware due to the advantages it offers for businesses. However, it’s crucial to consider both sides before making any decision. Here are some pros and cons, allowing you to make an informed choice for your business.Delaware LLC pros:

- Delaware allows a layer of anonymity and confidentiality for the owners of the LLC. The State of Delaware does not even know who owns a particular company. The state only knows who the Registered Agent is of the business.

- There are no state corporate income taxes for LLCs that operate outside of Delaware.

Delaware LLC Cons:

- The registration and maintenance fees in Delaware are generally higher as compared to other states. The initial registration fee is $140, and there is an annual report fee of $300. These costs can add up, especially for small businesses or startups with limited budgets.

- If you don’t reside in Delaware, you’ll need to maintain a commercial business address and a commercial registered agent in the state. This requirement increases the annual maintenance expenses for the LLC.

- In some states like California, if you are a resident and form a Delaware LLC, you may be required to register your LLC in California as well. Failure to comply with this requirement can lead to potential penalties.

Forming an LLC in home state:

Choosing to form your LLC in your home state offers several practical benefits.- One of the main benefits is that you are already familiar with the rules and regulations and laws over there, which allows for easier management and accessibility.

- You can conveniently handle day-to-day operations, attend meetings, and interact with local government agencies without the complications of operating from a different state.

- Forming an LLC in your home state may offer cost savings compared to forming one in Delaware. Home state registration fees and maintenance costs may be lower, especially if your state offers incentives or reduced fees for local business.

Is it better to form an LLC in Delaware or in your home state?

The better option is to form your LLC in your home state to prevent yearly costs and other complexities. Although, when deciding where to form your LLC, it’s essential to consider your specific business needs, long-term goals, and the nature of your operations. If your business plans involve seeking outside investment, attracting venture capital, or going public, Delaware’s established legal framework and familiarity to investors may be advantageous. On the other hand, if your business primarily operates locally and is not involved in complex transactions, forming your LLC in your state of residence can offer convenience and better alignment with local regulations.

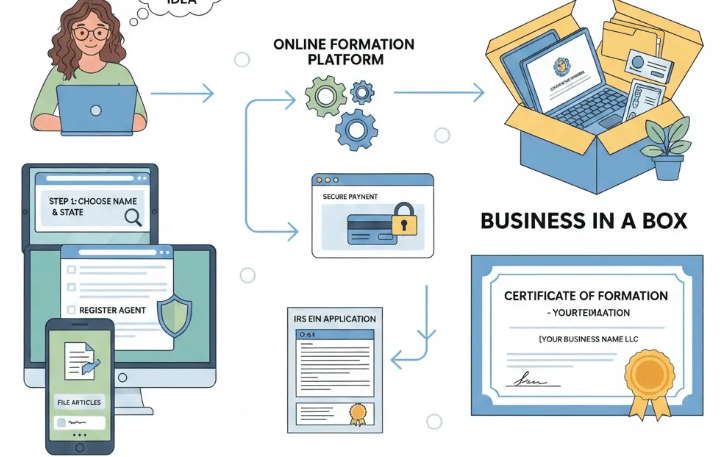

Form your LLC with BusinessRocket:

Whether you choose Delaware or your home state, BusinessRocket is here to assist you. Simplify the formation process with Business Rocket. Our platform provides step-by-step guidance, legal expertise, and personalized support to help you form your LLC efficiently and effectively. Visit our website today to get started on your LLC journey. Top Florida LLC Formation Services in 2026 February 16, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCTop Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of the …

Top Florida LLC Formation Services in 2026 February 16, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCTop Florida LLC Formation Services in 2026 File your Florida LLC today with a best service companies. Compare 2026 pricing, features, and pick the best provider to get started now. Fast and Secure Business REGISTER AN LLC Florida LLC formation services support one of the … Maryland LLC Formation Services in 2026 February 12, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCTop LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast for …

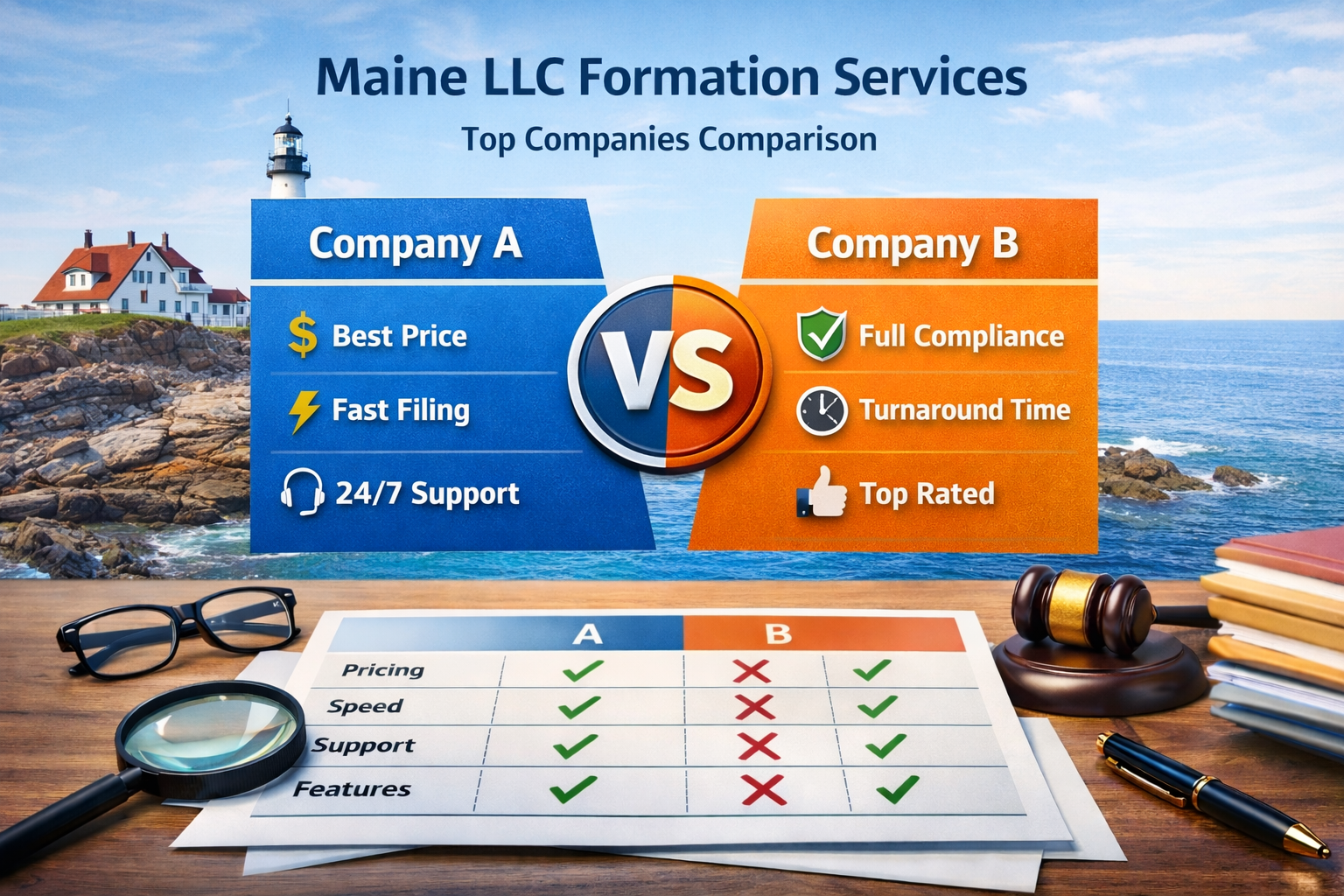

Maryland LLC Formation Services in 2026 February 12, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCTop LLC Formation Companies in Maryland Maryland LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Secure Business Packages REGISTER AN LLC Maryland Formation Services keep things moving fast for … Maine LLC Formation Services – Start Your LLC February 9, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCLLC Formation Maine – Top Companies Services Comparison In 2026, Maine LLC formation services matter more than ever. With most new businesses choosing LLCs, Maine offers founders a simple, flexible start. Fast and Secure Business Packages REGISTER AN LLC In 2026, maine LLC formation services …

Maine LLC Formation Services – Start Your LLC February 9, 2026 - Home » In-State vs. Delaware: Where Should You Establish Your LLCLLC Formation Maine – Top Companies Services Comparison In 2026, Maine LLC formation services matter more than ever. With most new businesses choosing LLCs, Maine offers founders a simple, flexible start. Fast and Secure Business Packages REGISTER AN LLC In 2026, maine LLC formation services …