As a business owner, you have likely encountered a wide range of legal requirements and regulations that you must abide by. From tax compliance to liability protection, it is important to understand the various components that make up the legal framework of your business.

And for that one of the most important components is to have a registered agent in place.

But what is a registered agent?

What is a Registered agent?

A registered agent, also known as a resident agent or a statutory agent, is a person or service assigned to receive legal documents on behalf of a business, such as subpoenas, regulatory and tax notices, and correspondence.

All limited liability companies (LLCs) and corporations are required to have a registered agent assigned to their business. This person or service must be available during normal business hours to receive important legal documents.

The Importance of Legal Document Receipt by Registered Agent:

When a business is served with legal documents, it is crucial to respond promptly and appropriately to avoid any negative consequences. Speaking of it, here comes the few importance of a registered agent in the receipt of legal documents.

1. Registered Agent Equals Company Owner for Legal Document Receipt:

When a registered agent is served with legal documents, it is considered the same as the owner of the company being served those documents. This is important to understand because it underscores the importance of having a registered agent who is reliable and available to receive legal documents on behalf of your business.

2. No Excuses: Confirmation of Receipt by Registered Agent:

A company cannot claim that it did not receive legal documents if there is confirmation that the registered agent received them. In other words, if the registered agent has confirmed receipt of a legal document, the company must respond quickly and accordingly.

These points emphasize the importance of having a registered agent who is available and reliable for the receipt of legal documents. By ensuring that your registered agent is up to the task, you can minimize the risk of missing important legal documents and protect your business from negative consequences.

Can a Company Owner be their Registered Agent?

Yes, company owners have the option to be their registered agents. Many small business owners choose to act as their registered agents to save money on registered agent services.

As mentioned above, The registered agent is the person or entity designated to receive official correspondence and legal documents on behalf of the company, which means that you must be available and accessible at the registered address during normal business hours to receive these important documents. And make sure you carefully consider the responsibilities and potential risks before making this decision.

Business Rocket Registered Agent:

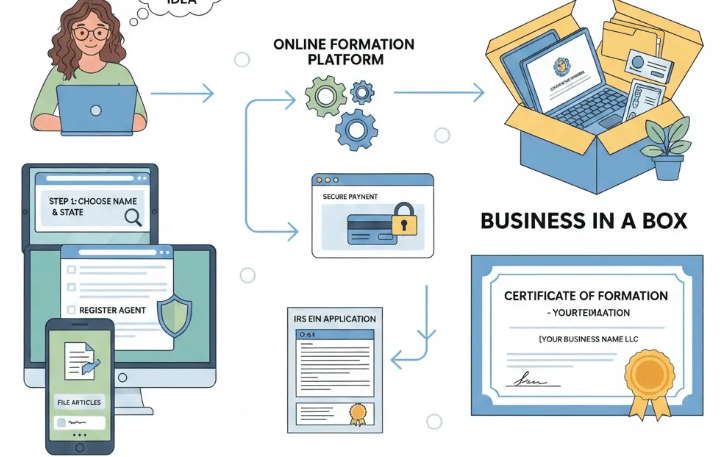

It’s better to be your registered agent unless there is an issue with providing an address in the state of registration. If this is not an option, BusinessRocket provides registered agent services nationwide and charges $0 for the first year and $149 thereafter.

Always remember, a registered agent is a crucial aspect of any LLC or corporation, as they play a vital role in ensuring the business remains compliant and up-to-date with legal requirements. Whether you choose to be your registered agent or utilize a service like BusinessRocket, it is important to understand the responsibilities and consequences involved.

Utah Business Search in 2026 – Check Name Availability March 8, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceUtah Business Entity Search in 2026 Utah Business Entity Search is an online tool that allows users to find business names and information about companies registered in the Utah state database. Fastest National Processing Times! REGISTER AN LLC The search tool is managed by the Utah …

Utah Business Search in 2026 – Check Name Availability March 8, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceUtah Business Entity Search in 2026 Utah Business Entity Search is an online tool that allows users to find business names and information about companies registered in the Utah state database. Fastest National Processing Times! REGISTER AN LLC The search tool is managed by the Utah …Utah Business Search in 2026 – Check Name Availability Read More »

Kentucky LLC Formation Services March 1, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceKentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the …

Kentucky LLC Formation Services March 1, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceKentucky LLC Formation Services in 2026 Kentucky LLC Formation Services help you by filing the $40 Articles of Organization, providing a registered agent, and managing the $15 annual reports. Start Your LLC Today REGISTER AN LLC Kentucky LLC formation services are in high demand as the … LLC North Carolina Services Provider February 27, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceNorth Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong …

LLC North Carolina Services Provider February 27, 2026 - Home » Registered Agent: Key to Business Formation & ComplianceNorth Carolina LLC Services in 2026 North Carolinad LLC formation services matter more than ever in 2026 because they offer founders a simple and flexible way to start a business. Fast and Best Business Packages REGISTER AN LLC North carolina llc formation services are seeing strong …