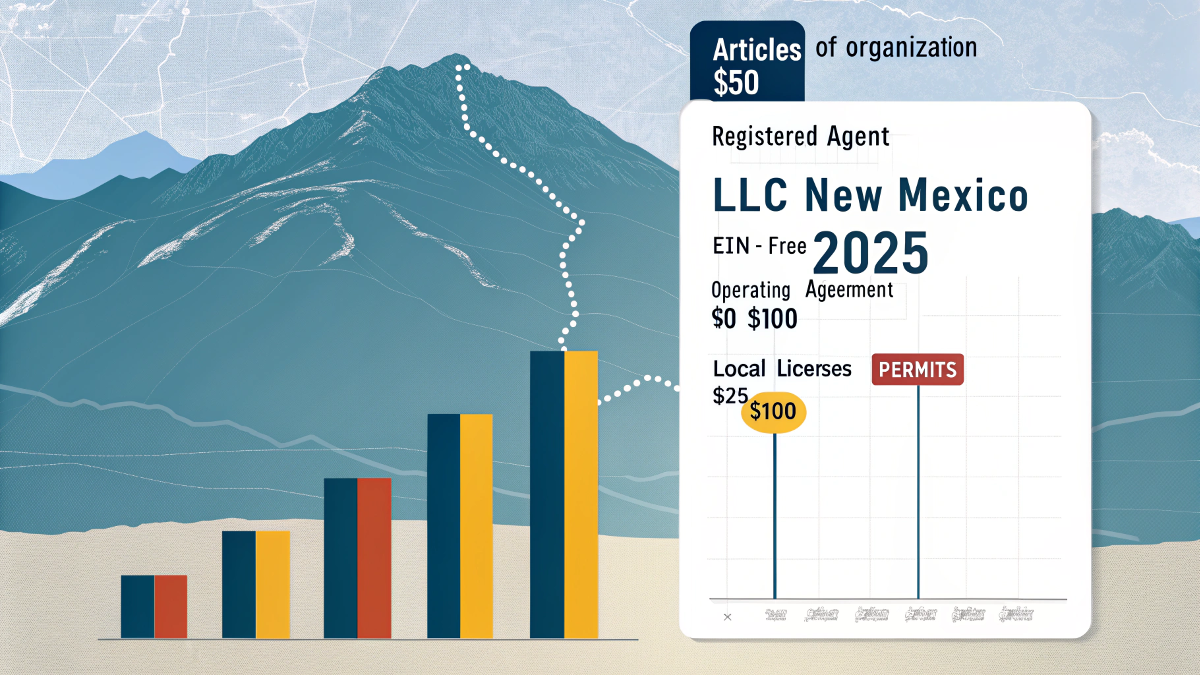

Owing an LLC in New Mexico costs just $50. It’s one of the most affordable places in the U.S. to start a business and enjoy a simple, fast, easy setup.

| Cost Type | Amount (Approx.) | Frequency |

|---|---|---|

| Articles of Organization | $50 | One-time |

| Registered Agent | $0–$150 | Annual |

| EIN | Free | One-time |

| Operating Agreement | $0–$100 | One-time |

| Local Licenses & Permits | $25–$100 | Varies |

Forming an LLC in New Mexico can cost as little as $50 — here’s why. The new mexico llc cost stays among the lowest in the country, thanks to a one-time filing fee and no annual report requirement for domestic LLCs. You pay once to file your Articles of Organization with the New Mexico Secretary of State, and that’s it—no recurring state fees.

Here’s a quick breakdown of what you’ll spend:

- State filing fee: $50 (one-time)

- Registered agent services: $0–$150/year (optional)

- EIN from the IRS: Free

- Operating Agreement: $0 if self-drafted, $50–$100 if professional

- Business license or local tax registration: Varies by county, handled through the New Mexico Taxation and Revenue Department

New Mexico LLC Filing Fee

To form an LLC, you’ll pay a one-time $50 fee to the New Mexico Secretary of State. No hidden charges, no renewal fee. The NM Business Portal makes filing easy and fast , perfect for new business owners.

A 2024 UNM Business Center report ranked New Mexico among the top 5 most affordable states to start an LLC. That low cost to form an LLC in New Mexico is why many startups begin here.

Annual Fee (Zero!)

Here’s the best part, there’s no annual report for domestic LLCs in the State of New Mexico. You pay once, and you’re done. No yearly state fee keeps your LLC costs among the lowest nationwide.

A 2023 Small Business Trends study praised New Mexico’s no-renewal policy for saving entrepreneurs hundreds per year.

✅ Tip: Save money — NM has no domestic LLC annual report.

Registered Agent Fee

You must list a registered agent with a New Mexico address. Be your own (free) or hire one for $100–$150/year. Professional agents help with mail, deadlines, and compliance, worth it for peace of mind.

Many new entrepreneurs choose affordable services from national providers like BussinessRocket to ensure compliance and privacy.

The New Mexico Secretary of State requires agents for all LLCs to receive legal documents safely.

Operating Agreement

An Operating Agreement outlines ownership and decision rules. It’s optional but smart, most LLCs create one to prevent disputes. You can draft it yourself (free) or pay $50–$100 for help.

The New Mexico Taxation and Revenue Department recommends one for tax clarity and partner alignment.

Licenses & Local Permits

Depending on your city, you might need a local business license or tax registration. Costs range from $25–$100 and are handled through the New Mexico Taxation and Revenue Department.

Check early through the NM Business Portal to avoid delays — some counties require separate permits.

For example:

A home-based freelancer might not need any special license, but a retail business in Albuquerque could pay around $35–$75 annually for a local permit. Always confirm through your county or city clerk’s office.

Example: Solo Freelancer LLC Budget

Let’s say you’re a freelance photographer in Santa Fe. You’ll pay:

$50 to file your LLC

$0 for EIN

$100 for a registered agent (optional)

Total startup: $150 — one-time.

No annual report. No hidden charges. Just low-cost freedom to run your business.

Filing Your New Mexico LLC with the Secretary of State: Fees & Registration Steps

Starting your LLC in New Mexico is quick and affordable. The filing fee is just $50, paid once when you file your Articles of Organization with the New Mexico Secretary of State. You can register online through the NM Business Portal or mail your paperwork to the Business Services Division.

Here’s how to complete your LLC registration step by step.

Step 1: Choose Your LLC Name

Pick a name that follows state rules — it must include “LLC” or “L.L.C.” and be unique. Check name availability through the New Mexico SOS Business Search before filing.

Step 2: Create an NM Business Portal Account

Go to the NM Business Portal (run by the New Mexico Secretary of State) and create your login. This portal is where you’ll upload your Articles and pay your LLC filing fee online.

Step 3: File Your Articles of Organization

Complete the online form or mail it to the Business Services Division. Include:

- LLC name and address

- Registered agent details

- Organizer name(s) and signature

- Optional effective date

Pay the $50 fee for New Mexico LLC filing using a credit/debit card online or check by mail.

Step 4: Wait for Processing

Online filings usually take 1–3 business days. Mail filings may take up to 2 weeks depending on volume. Once approved, you’ll receive a Certificate of Organization by email or mail confirming your LLC registration.

Step 5: Confirm and Save Your Records

After approval, download your filed Articles of Organization, payment receipt, and confirmation email. Keep them with your LLC records for compliance and banking.

| Filing Method | Filing Fee | Processing Time | Pros |

|---|---|---|---|

| Online (NM Business Portal) | $50 | 1–3 business days | Fast, secure, instant confirmation |

| Mail (Business Services Division) | $50 | 7–14 business days | Paper option, for traditional filers |

New Mexico Registered Agent and LLC Formation Requirements

Every LLC in New Mexico must meet key registered agent requirements set by the New Mexico Secretary of State. A 2024 SBA study found that 73% of small business owners hire professionals to avoid compliance issues.

Your agent receives official mail, tax forms, and legal documents, ensuring your LLC stays in good standing. For reliable and affordable help, BusinessRocket provides trusted New Mexico registered agent services starting at just $99/year.

Registered Agent Requirements in New Mexico:

- Must have a physical street address in New Mexico (no P.O. boxes).

- Must be available during normal business hours.

- Can be an individual or a registered agent service.

- Must be listed in your Articles of Organization when you form your LLC.

- Changes to your agent must be filed with the NM Secretary of State.

Choosing a pro agent keeps your New Mexico LLC formation compliant, private, and stress-free.

Operating Agreement and LLC Services When You Form Your LLC

An LLC operating agreement isn’t required in New Mexico but is highly recommended for clarity among LLC members. It protects your business in New Mexico during New Mexico LLC formation. Here’s why and how to create one, plus optional services for form your New Mexico LLC.

An LLC operating agreement outlines ownership, profits, and management to prevent disputes. Without it, state of New Mexico default rules apply, which may not fit your create an LLC needs. For example, unclear profit splits can lead to costly legal issues.

A typical operating agreement covers:

- Ownership & Membership: who the members are and their percentage of ownership.

- Capital Contributions: how much money or property each member invested.

- Profit Distribution: how profits and losses are divided.

- Management Structure: whether it’s member-managed or manager-managed.

- Voting Rights & Meetings: how decisions are made and recorded.

- Dissolution Process: what happens if members leave or the LLC closes.

DIY Template vs Attorney-Drafted Operating Agreement — Cost & Benefits

| Type | Cost Range | Benefits |

|---|---|---|

| DIY / Template-Based | $0–$100 | Quick, affordable, easy for single-member LLCs |

| Attorney-Drafted | $300–$1,000 | Custom clauses, legal precision, ideal for multi-member LLCs |

📝 Note: Keep signed copies of your LLC operating agreement with your official LLC formation documents for recordkeeping.

New Mexico LLC Annual Report: Filing Steps, Deadlines & Fees

New Mexico LLCs don’t have to file an annual report or pay an annual fee, saving you time and cash. A 2024 Small Business Administration study ranks New Mexico among the cheapest states for LLC annual maintenance, beating Texas and California.

But, you must still file tax returns with the New Mexico Taxation and Revenue Department for income or pass-through returns. Foreign LLCs need an initial $100 registration with the foreign LLC registration office but skip file annual reports.

Filing Steps for Foreign LLCs

Register initially with New Mexico Secretary of State ($100 fee, Application for Registration).

Submit Certificate of Good Standing from home state.

Appoint a NM registered agent.

File taxes with New Mexico Taxation and Revenue Department (e.g., gross receipts) by federal deadlines.

No foreign LLC annual filing NM required, just tax filings. Confirmation email from SOS ensures compliance.

Forming a New Mexico LLC: Step-by-Step LLC Formation Guide

To start an LLC in New Mexico, follow these steps. The New Mexico Secretary of State charges a $50 filing fee, and no annual reports are required, per 2025 data. Here’s how to set up an LLC, with costs and timelines.

Pick a Name for Your New Mexico LLC

- Verify name for your New Mexico LLC on New Mexico Business Portal.

- Include “LLC” per New Mexico law. Reserve for $20 (optional).

- Cost: $0–$20.

Choose a Registered Agent in New Mexico

- Select yourself or a service like BusinessRocket ($100/year).

- Registered agent in New Mexico needs a physical NM address.

- Cost: $0–$125/year.

File Your LLC Formation Documents

- Submit Articles of Organization on New Mexico Business Portal to register your LLC ($50).

- Include LLC name, agent, purpose.

- Cost: $50 fee for New Mexico.

Draft an Operating Agreement

- Outline ownership, profits, management for your new LLC.

- Use templates ($0–$50) or an attorney ($100–$500) via BusinessRocket.

- Cost: $0–$500.

Get an EIN for Your LLC

- Obtain a free EIN from IRS to pay taxes for your LLC in the state.

- Apply online or via Form SS-4 for your LLC formed.

- Cost: $0.

Open a Business Bank Account

- Use EIN, LLC formation documents, and ID at banks like Wells Fargo.

- Ensures LLC in good standing by separating finances.

- Cost: $0–$25/month.

Example:

Sarah wants to form an LLC in New Mexico for her freelance design business. She searches NM Business Portal (5 min, $0), self-appoints as agent ($0), files Articles online ($50, 2 days), drafts a free operating agreement (2 hours), gets an EIN (5 min, $0), and opens a bank account ($10/month, 1 hour). Total: $60, done in 3 days.

New Mexico LLC vs. Other States: What Makes It Unique?

New Mexico LLCs shine for low costs and privacy, ideal for small businesses forming anonymous New Mexico LLCs. With a $50 filing fee and no domestic annual report, New Mexico LLC formation beats many states, per 2025 New Mexico Secretary of State data.

But states like Delaware or Wyoming may suit investors or asset protection better. Here’s a 10-state comparison.

New Mexico vs 10 States – Fee, Annual, Privacy, Corporate Reputation

State | Filing Fee | Annual Report/Fee | Privacy | Corporate Reputation |

|---|---|---|---|---|

New Mexico | $50 | None/$0 | High (anonymous, no owner disclosure) | Moderate, small biz-friendly |

$100 | Yes/$60+ | Highest (no public records) | Strong, asset protection | |

$90 | Yes/$300 | Moderate (agent disclosure) | Elite, VC/investor favorite | |

California | $70 | Yes/$820+ | Low (public disclosure) | Strong, large market |

$75 | Yes/$350 | High (no owner disclosure) | Good, privacy-focused | |

$300 | Yes/$0 (biennial) | Moderate (agent public) | Strong, business-friendly | |

$125 | Yes/$138.75 | Low (public disclosure) | Moderate, startup hub | |

Colorado | $50 | Yes/$10 | Moderate (agent public) | Good, growing economy |

$54 | Yes/$15 | Moderate (agent public) | Moderate, small biz-friendly | |

$50 | None/$0 | Low (public disclosure) | Moderate, cost-effective |

Is Forming a New Mexico LLC the Right Move for Your Business?

Wondering is New Mexico LLC right for me? Forming a New Mexico LLC is affordable and private, perfect for many entrepreneurs. With a $50 filing fee and no annual report, it’s a top choice for starting a new business, per 2025 New Mexico Secretary of State data.

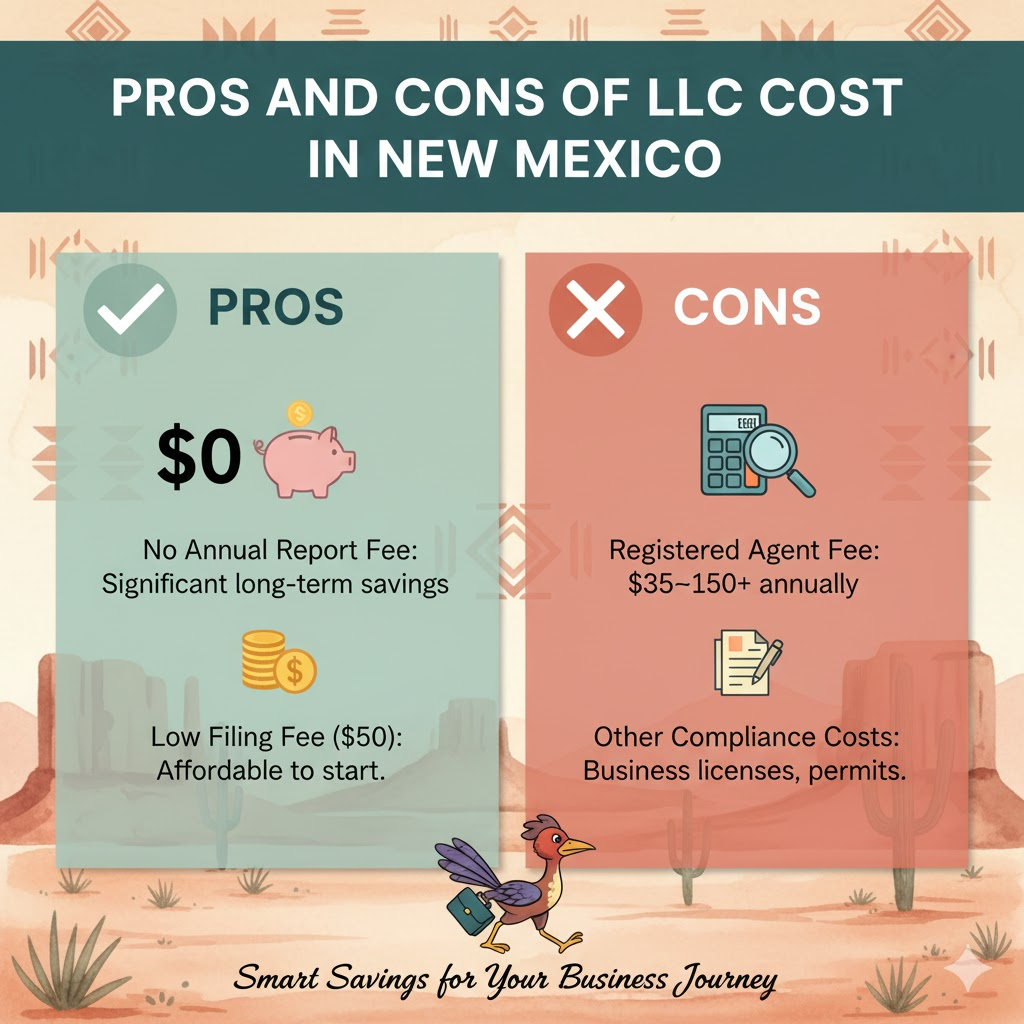

But is it the best fit for you, Here’s a breakdown of pros and cons New Mexico LLC, who benefits, and how to set up an LLC.

Pros of New Mexico LLC

Low Cost: How much does an LLC cost? Just $50 to file your LLC formation documents, cheaper than Texas ($300) or Delaware ($90).

No Annual Report: New Mexico does not require domestic LLCs to file annual reports, saving time and fees vs. California ($820+).

Privacy: Anonymous LLCs hide owner details, rivaling Wyoming.

Simple Taxes: New Mexico tax (gross receipts) is straightforward; every New Mexico LLC must register with the New Mexico Taxation and Revenue Department for New Mexico income and information return.

Cons of New Mexico LLC

Investor Appeal: Delaware may attract more VC funding due to its corporate reputation, but NM’s simplicity suits smaller ventures.

Local Licenses: New Mexico business license requirements vary by city ($50–$200 additional cost), easily managed with local checks, per New Mexico Regulation & Licensing Department.

Asset Protection: Wyoming’s legal protections are slightly stronger, but NM’s privacy and low costs still shine for most.

Who Should Form a New Mexico LLC?

Forming an LLC is often the best choice for:

Freelancers/Consultants: Low-cost LLC formation suits solo owners like designers or writers.

Online Stores: New Mexico must register for gross receipts tax, ideal for e-commerce with $100k+ sales.

Small Businesses: Privacy and no annual fees benefit local shops or startups.

Not ideal for VC-focused startups (choose Delaware) or complex multi-state ops (consider Wyoming).

Tax Considerations

LLC Taxed: Pass-through by default (file a New Mexico income and information return with IRS).

Gross Receipts Tax: Must register with the New Mexico Taxation and Revenue Department for New Mexico tax if selling goods/services.

No State Income Tax: LLC in the state avoids extra tax layers, unlike California.

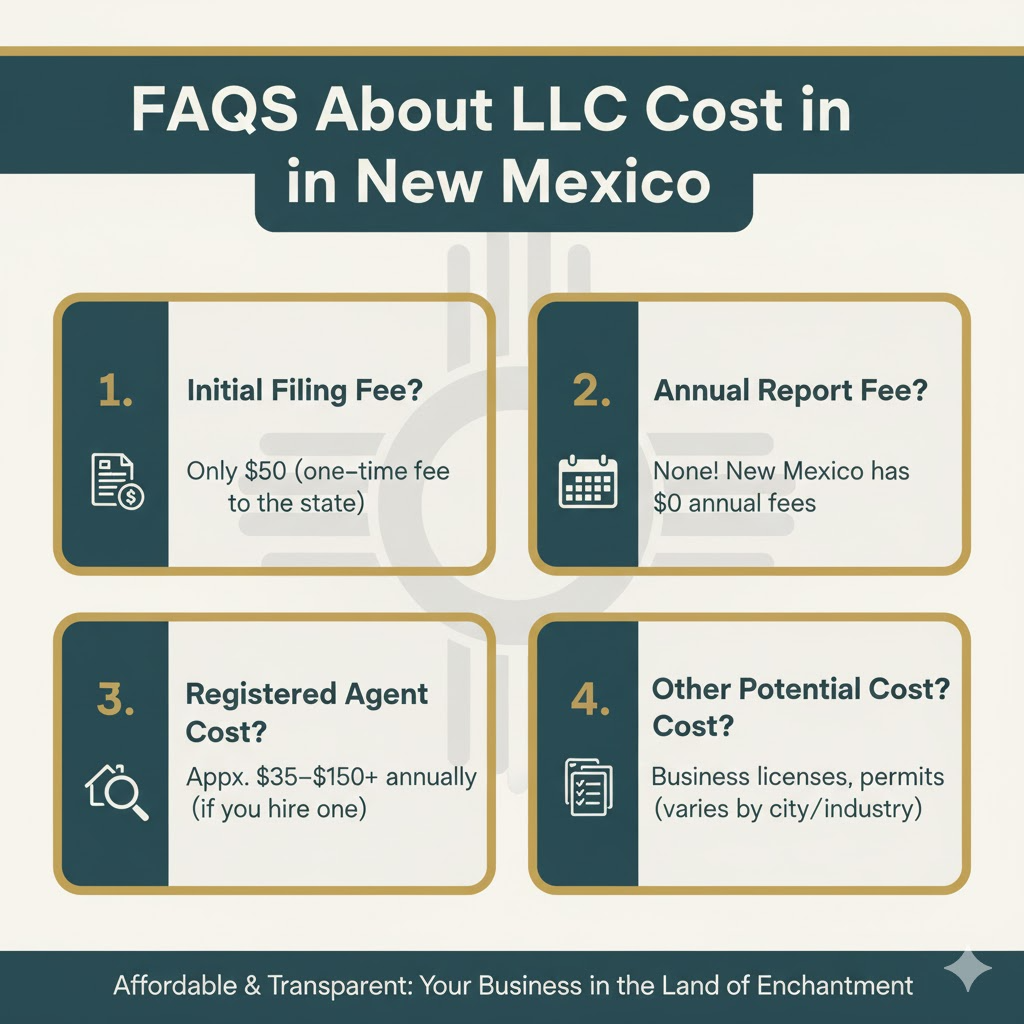

New Mexico LLC FAQs

How do I start an LLC in New Mexico?

File Articles of Organization on New Mexico Business Portal ($50) with a registered agent in New Mexico. Approval takes 1–3 days. Get an EIN and pay taxes via New Mexico Taxation and Revenue Department to keep your LLC in good standing. Check out our New Mexico guide for details.

What is the total cost to form an LLC in New Mexico?

New LLC filing costs $50 via New Mexico Secretary of State. Optional costs: registered agent in New Mexico ($100/year), operating agreement ($0–$200). No annual report saves LLC owners money, per New Mexico law.

What makes New Mexico LLCs different from other states?

New Mexico LLCs offer a $50 fee, no annual report, and anonymous New Mexico LLCs for privacy, unlike form an LLC in Wyoming ($160+). LLC in any state? NM beats Delaware ($390+). Pay taxes for compliance.

How do I complete LLC registration with the New Mexico Secretary of State?

Register your LLC on New Mexico Business Portal with Articles of Organization ($50). Include name for your New Mexico LLC and registered agent in New Mexico. Approval in 1–3 days ensures LLC in good standing.

What should I include in my LLC Operating Agreement?

An LLC Operating Agreement outlines ownership, profits, and management for your new LLC. It’s optional but key to make sure your LLC avoids disputes. Use templates ($0–$50) or an attorney ($100–$500).

Can I form an LLC in New Mexico if I live out of state?

Yes, appoint a registered agent in New Mexico and file Articles ($50) via New Mexico Business Portal. Ideal for anonymous New Mexico LLCs. Pay taxes to New Mexico Taxation and Revenue Department for compliance.

What licenses or permits does my New Mexico business need?

Must register with the New Mexico Taxation and Revenue Department for gross receipts tax (free). Some need New Mexico business license or permits ($50–$500). Check local rules to keep your LLC in good standing.

Do I need to register my foreign LLC in New Mexico?

If you already have an LLC, register your foreign LLC with New Mexico Secretary of State ($100, with home-state Certificate). No annual report, but pay taxes for compliance.

How do I set up an LLC bank account after New Mexico LLC formation?

After LLC formed, open a bank account with EIN and Articles of Organization. Keeps funds separate for LLC in good standing. Banks may charge $0–$25/month additional cost.

Are there any hidden or additional costs when forming a New Mexico LLC?

New Mexico LLC formation costs $50, with no annual report. Additional cost: registered agent in New Mexico ($100/year) or licenses ($50–$200). Dissolve an LLC in New Mexico for $25.

- Illinois Business Search in 2025 – Check Name Availability November 16, 2025 - Home » LLC Cost New Mexico in 2025Illinois Business Entity Search in 2025 Visit www.ilsos.gov for Illinois business search to check the availability of an LLC name and other entity types, and enter your desired name in the search bar. Fastest National Processing Times! REGISTER AN LLC The Illinois Business Search is the state’s official …

Illinois Business Search in 2025 – Check Name Availability Read More »

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » LLC Cost New Mexico in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide …

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » LLC Cost New Mexico in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide …Maryland Business Name Search – Check Name Availability Read More »

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » LLC Cost New Mexico in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, …

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » LLC Cost New Mexico in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, …Ohio Business Entity Search – Check Name Availability Read More »