Starting a business in Georgia is easy with just $100 to file and $50 yearly. Forbes 2025 ranks Georgia among the top 10 states for small business success.

Let’s dive into all Georgia LLC costs, taxes, and fees to launch your dream venture! The Georgia Secretary of State offers straightforward fees for your business entity. Beyond the filing fee, consider extras like a registered agent or Georgia LLC operating agreement. Even with these, most Georgia LLCs cost under $300 total. It’s affordable and perfect for entrepreneurs ready to shine.

In this guide, we’ll break down Georgia LLC cost, what’s included, and why it’s a smart choice for your business name.

Georgia LLC Fee Table for 2025

| Fees | Cost |

|---|---|

| LLC filing fee | $100 (online) |

| Annual Registration | $50 |

| Registered agent | $50–$150 |

| Business license | Varies by county |

| Reserve LLC name | $25 (online) |

| Fictitious Name | $50–$100 (varies) |

| Operating agreement | $0–$200 |

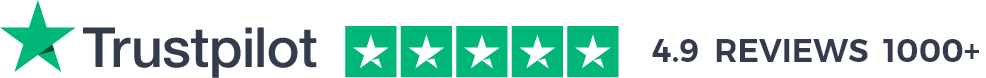

Cost of Forming an LLC in Georgia: Step-by-Step Guide (2025)

Ready to form an LLC in Georgia? Here’s the Georgia LLC cost breakdown with mandatory and optional fees to plan your budget. These steps make forming your LLC simple, letting small business owners focus on growth.

1️⃣ Georgia LLC Filing Fee: $100 (file your Articles of Organization)

2️⃣ Annual Registration Fee: $50 (file an annual report)

3️⃣ Registered Agent Fee: $50–$150 (optional service)

4️⃣ Business License: Varies by county

5️⃣ Georgia LLC Operating Agreement: $0–$200 (optional)

Georgia LLC Filing Fee

Launch your business in Georgia with a $100 fee to file your Articles of Organization online via sos.ga.gov. File by mail for $110, or expedite for $250 (same-day if submitted before noon on business days). The Georgia Corporations Division ensures transparency, which is ideal for business owners. A 2025 Inc. report highlights Georgia’s low fees as a startup advantage.

Annual Registration Fee

Stay compliant with a $50 annual registration, due April 1 via sos.ga.gov. File by mail for $60, with a $25 late fee if delayed. Georgia law keeps the process clear, so Georgia LLCs thrive without hassle. This low cost lets small businesses prioritize their vision over paperwork.

Registered Agent Fee

A registered agent manages legal documents during business hours, costing $50–$150 yearly. Required by Georgia law, they keep your business structure compliant with a Georgia address. This gives LLC owners confidence to grow their business name. Compare services to find the perfect match for your small business.

Business License

Some Georgia LLCs require county-specific licenses, costing $50–$500 based on location. About 60% of businesses need one, per a 2025 SBA report. Check your county’s rules to stay compliant, as advised by the Georgia Secretary of State. This keeps your business in Georgia running smoothly and legally.

Georgia LLC Operating Agreement

A Georgia LLC operating agreement outlines roles and finances for $0–$200; it is optional but key for single-member LLCs or partnerships. Templates keep non-US resident LLC costs low, boosting investor trust. The Georgia Secretary of State recommends it for clarity. Protect your business entity and set your small business up for success.

Starting an LLC in Georgia is affordable, simple, and transparent—usually under $300 total. For small business owners, that means fewer barriers and more focus on growth. Get your business bank account with an EIN from IRS and launch via sos.ga.gov today!

Georgia LLC Articles of Organization Filing Fee ($100)

To launch a Georgia limited liability company, you must file the Georgia Articles of Organization. The state filing fee is $100 online or $110 by mail, processed through the Georgia Secretary of State Corporations Division. This step is non-negotiable every Georgia LLC must do it.

Key points you can’t skip:

- Filed with the Georgia Secretary of State

- Processing time: about 15 business days

- Details required: LLC members, type of business, address in the state

- Annual costs: report fees + cost of local business permits

- LLC taxes: pass-through, unless the LLC elects to be taxed differently

Georgia requires this filing to keep an LLC in good standing. Once approved, you can move on to an EIN for your LLC, draft an LLC operating agreement template, and handle compliance. Straightforward, affordable, and practical—Georgia is a great state to start an LLC with predictable costs and simple rules.

How Much Does It Cost to Start an LLC in Georgia?

Starting a limited liability company in Georgia means covering a few key fees. The main one is filing the Georgia Articles of Organization through the Georgia Secretary of State website, which every Georgia LLC must do. Most extras are optional but worth noting when you form your LLC in Georgia.

Total cost to start looks like this:

- Articles of Organization: $100 online / $110 by mail (file your Georgia Articles with the Secretary of State and pay).

- Name Reservation (optional): $25 via the Georgia Secretary of State’s office.

- Certified Copies / Certificate of Existence: $10–$20.

- EIN: Free from IRS (required for a multi-member LLC).

- Operating Agreement: Free with template, or $200–$1,000 with an attorney.

- Business Licenses/Permits: Vary by county; check with the Georgia Department of Labor.

The LLC itself does not pay tax to the state, though an LLC to be taxed differently can elect so. If registering a foreign LLC or expanding an LLC in another state, you’ll repeat these steps.

According to the Georgia Secretary of State’s office, processing takes about 15 business days. Simple, affordable, and clear Georgia is a great state to launch.

Georgia Business License and Permit Fees (Varies by Industry)

In the state of Georgia, licenses aren’t issued at the state level, Georgia does not require a general statewide license. Instead, your city or county decides. Atlanta may ask for an occupational tax certificate, Savannah could add zoning permits, and Augusta may require inspections.

The type of business matters most: a restaurant pays health permit fees, a contractor handles professional licensing, while daycare owners need safety checks.

Stronger breakdown:

- Occupational tax certificate: every local business must get one.

- Professional licenses: contractors, medical, childcare.

- Local permits: fire, health, zoning, alcohol (if applicable).

- Costs: anywhere from $50 to several hundred depending on industry + location.

For LLCs in Georgia, this step follows LLC registration. You first form with the Georgia Secretary, then add licenses to stay compliant. The process is practical LLC in Georgia is easy compared with an LLC in any state.

Whether you expand or dissolve an LLC in Georgia, permits tie back to the locality. Simply put, Georgia is a great state for entrepreneurs, and with Georgia with our step-by-step guide, it’s simple to start your Georgia LLC.

Georgia Registered Agent Fee ($0 or $125/year) Breakdown

Every LLC in Georgia must list a registered agent. Serving as your own costs $0, but it means your home address is public. If you’d rather keep privacy, professional services run $100–$150 per year.

Think of it this way:

- Free if you’re your own RA → state mail and legal papers arrive at your door.

- Paid service → privacy, compliance reminders, and reliable handling.

- Annual fee due April 1 through the Secretary of State

- Late penalty: $25 if missed

- Professional services (like BusinessRocket) handle filings, reminders, and mail forwarding

For example: A bakery owner in Atlanta used her home as the RA. A lawsuit notice arrived during business hours in front of customers embarrassing and stressful.

Ongoing LLC Costs in Georgia: Taxes, Compliance, and Renewals

Starting is one thing, keeping your LLC running is another. Once you register an LLC, the real planning comes with ongoing fees and taxes. Georgia makes it manageable. Unlike some states, Georgia does not require a franchise tax, which saves money each year. Still, you’ll want to budget for the basics: state taxes, sales tax, and payroll if you hire.

Here’s a simple view:

- State income tax: flat 5.75% on profits

- Sales tax: 4% state + local rates (varies by county/city)

- Payroll taxes: if employees are on your books

- Annual report: $50, due April 1

- Compliance: keep an IRS EIN and updated records with the Georgia Department of Revenue

| Cost Type | Amount / Notes | Who Pays / When |

|---|---|---|

| State Income Tax | 5.75% flat rate | All LLCs filing income |

| Sales Tax | 4% + local rates | LLCs with taxable sales |

| Payroll Taxes | Federal + state contributions | LLCs with employees |

| Annual Report | $50 due April 1 | Every active LLC |

| Franchise Tax | None | Benefit → LLC in Georgia is easy |

Even a single-member LLC needs to file and report. You can file online for most of these requirements, keeping it quick and paperless. Georgia’s structure is clear: stay compliant, renew on time, and your LLC in good standing keeps running smoothly. For many, Georgia is a practical, low-cost place to build form, file, renew, repeat.

DIY or Professional LLC Formation in Georgia: Cost & Process

Setting up an LLC in Georgia can be done two ways—DIY or with professional help. The SOS portal makes the do-it-yourself route quick; most people finish in under an hour. You check your name, file Articles of Organization, pay the $100 fee, grab an EIN from the IRS, and draft an operating agreement. That’s the core.

DIY steps:

- Name check through SOS portal

- File Articles + pay fee online

- EIN issued free by IRS

- Draft an operating agreement (even single-member)

Professional services add structure:

- Handle filings on your behalf

- Provide templates and compliance reminders

- Registered agent and privacy protection

- Guidance if you scale or expand

Both paths work. DIY filing is cost-effective, but professional formation ensures no steps are missed. Either way, forming an LLC in Georgia stays simple, affordable, and built for speed.

Hidden Costs to Forming a Georgia LLC You Shouldn’t Ignore

Filing fees get your company started, but running an LLC comes with extras many owners overlook. Think of them as “quiet costs” that don’t show up on the state’s website yet matter for stability and growth. A strong business budget accounts for these before they sneak up.

Watch out for:

- Business insurance → liability coverage, usually $300–$1,000/year

- Accountant fees → bookkeeping, tax prep, compliance costs

- Legal agreements → contracts, partnership terms, IP protection

- Domain & website hosting → from $10/month for basic hosting to $500+ for full sites

- Professional tools → payroll systems, invoicing software, virtual office services

According to the Small Business Administration, nearly one in three small businesses face unexpected compliance or insurance costs in their first year. These aren’t state-mandated, but they keep your company protected, credible, and competitive. Insurance shields assets, an accountant ensures tax accuracy, and a simple website builds trust—investments that help your Georgia LLC grow and stay strong.

FAQs About Georgia LLC Costs

Is there a franchise tax for LLCs in Georgia?

No, Unlike some states, Georgia law skips franchise taxes for limited liability companies, saving you cash. File through sos.ga.gov without worrying about extra recurring costs. This keeps your Georgia LLC cost low and predictable. Your small business gets to keep more of its profits.

Do I need a business license for my Georgia LLC?

It depends. Local counties or cities set license rules, with 60% of business in Georgia needing one, per the Georgia Secretary of State. Fees range from $50 to $500 based on your industry and location. Check your local office to stay legal. This protects your business structure from day one.

How long does LLC approval take after filing?

About a week. Online LLC filing ($100) via sos.ga.gov takes 7 business days for approval. File by mail ($110) stretches to 10–15 days, or expedite for $250 same-day. The Georgia Corporations Division keeps the process quick. Your business name is ready to shine fast.

Can I reserve an LLC name in advance?

Yes. For $25, reserve LLC name online with the Georgia Secretary of State for 30 days. It locks in your business name while you prep file your Articles of Organization. This step safeguards your brand identity. It’s a small price for peace of mind.

Are LLC filing fees deductible?

Yes. The $100 file your Articles of Organization fee and $50 file an annual are deductible, per IRS rules. This lowers Georgia LLC cost for LLC owners starting out. Chat with a tax pro to maximize savings. Your small business budget stretches further.

What happens if I miss the annual registration?

You’ll face fees. Missing the April 1 file an annual ($50) deadline triggers a $25 late fee, per Georgia law. Non-payment risks dissolving your business entity. File online via sos.ga.gov to stay compliant. Keep your Georgia LLCs active without stress.

Can non-residents form an LLC in Georgia?

Yes. Foreigners pay $100 to form an LLC in Georgia, plus $50–$150 for a registered agent. Get a free EIN from IRS for a business bank account. Non us resident llc cost matches locals, per Georgia Secretary of State. Start your business in Georgia from anywhere.

Is Georgia cheaper than Florida or Delaware for LLCs?

Yes. Georgia’s $100 LLC filing and $50 annual fee beat Florida ($125, $138.75) and Delaware ($90, $300). A 2025 Inc. report ranks Georgia budget-friendly for startups. File online to save more. Small business owners thrive with these low costs.

Do I have to pay for an EIN?

No. An EIN is free via IRS for your business bank account or single-member LLC. Apply online or by mail in 1–4 weeks, no cost. It’s essential for forming your LLC in Georgia. This keeps your startup wallet-friendly.

What’s the cheapest way to keep a Georgia LLC compliant long-term?

File an annual ($50) on time and use a $50 registered agent for business hours compliance. Skip pricey Georgia LLC operating agreement templates by using free ones. Avoid late fees to minimize Georgia LLC cost. Your business in Georgia stays lean and thriving.

Related Article About LLC

- Illinois Business Search in 2025 – Check Name Availability November 16, 2025 - Home » LLC Cost Georgia in 2025Illinois Business Entity Search in 2025 Visit www.ilsos.gov for Illinois business search to check the availability of an LLC name and other entity types, and enter your desired name in the search bar. Fastest National Processing Times! REGISTER AN LLC The Illinois Business Search is the state’s official tool …

Illinois Business Search in 2025 – Check Name Availability Read More »

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » LLC Cost Georgia in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide Step …

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » LLC Cost Georgia in 2025Maryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide Step …Maryland Business Name Search – Check Name Availability Read More »

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » LLC Cost Georgia in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, and …

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » LLC Cost Georgia in 2025Ohio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, and …Ohio Business Entity Search – Check Name Availability Read More »