Starting an LLC in Wyoming costs more than the $100–$110 filing fee. You’ll owe a $60 annual report fee, plus extra if assets exceed $250,000.

No initial Statement of Information is required. Many peoples hire a registered agent ($50–$300/year) for legal handling. Budget for licenses, permits, and legal fees ($200–$1,000) to stay compliant. I’m here to spill all the 2025 Wyoming cost details fees, taxes, and sneaky extras so you can jump into your business in Wyoming without surprises. Let’s make this easy!

Forming a Wyoming LLC is dirt-cheap and hassle-free. In 2025, Wyoming LLCs are a top pick for entrepreneurs because of low fees and zero state income tax. Toss in a registered agent or name reservation, and you’re still under $300 total. It’s simple, affordable, and feels like the perfect spot to form your LLC.

This guide breaks down every cost for limited liability companies in Wyoming, from must-haves to optional add-ons, so you can budget like a pro.

Wyoming LLC Fee Table in 2025

| Fees | Cost |

|---|---|

| LLC filing fee | $100 |

| Annual Report Fee | $60 |

| Registered agent | $50–$200 |

| Business license | Varies by city |

| Reserve LLC name | $50 |

| Fictitious Name (DBA) | $100 |

| Operating agreement | $0–$200 |

Gain robust asset protection and peace of mind. Our experts handle your Wyoming LLC registration, ensuring a smooth, stress-free start to your entrepreneurial journey.

Cost of Forming an LLC in Wyoming: Step-by-Step Guide (2025)

Let’s talk about the cost of starting an LLC in Wyoming. Here’s a quick rundown of fees. required and optional, so you can plan your state business budget. Follow these steps to get your business entity up and running!

Wyoming LLC Filing Fee

To form an llc in Wyoming, you’ll pay $100 to the Wyoming SOS. Add $4 for online filing if you’re in a rush. This one-time fee gets your business entity registered. It’s a steal compared to other states.

Wyoming’s fees are clear, with no hidden gotchas, per 2025 Wyoming SOS data. Small businesses love the low cost. Kick things off and save big.

Annual Report Fee

You’ll owe $60 a year when the annual report is due to keep your LLC active. File by the first day of your formation month via Wyoming SOS. The report is due to avoid shutdown risks. The Wyoming Department of Revenue says no state income tax makes this even sweeter.

Wyoming’s 2025 rules Keep it simple, per government records. Filing on time boosts your credibility. Stay sharp and keep your Wyoming LLCs in good shape.

Registered Agent Fee

A registered agent costs $50–$200 a year to handle legal papers for your limited liability companies. It’s required to form a Wyoming LLC and keeps you compliant. Wyoming’s privacy perks make it a smart choice. Pick a service that fits your vibe.

The Wyoming SOS. requires this for all businesses. It adds a pro touch, per the Wyoming Business Council. Choose wisely to focus on your business in Wyoming.

Business License

Some cities charge $25–$500 for a business license, depending on your state business type. Roughly 60% of Wyoming LLCs need one, based on local rules. Check your city’s website to confirm. It’s a small step to stay legal.

Wyoming skips statewide licenses, per Wyoming SOS 2025 data. Local compliance is easy to sort out. Get licensed and keep your business rolling.

Wyoming LLC Operating Agreement

An operating agreement, costing $0–$200, spells out your business entity’s rules and finances. Most limited liability companies benefit from one—80% see smoother operations. Use a free template or hire a pro. It protects your form for your LLC setup.

Wyoming’s Wyoming SOS suggests this for clarity. The University of Wyoming notes it builds investor trust. Set clear terms and watch your Wyoming LLC shine.

Pay for only what you need, get your Wyoming LLC active in record time!

How Much Is the Wyoming LLC Filing Fee

The Wyoming LLC filing fee is just $100 online or $102 by mail in 2025. This pays for your Wyoming LLC Articles of Organization, the must-have document to register your business entity with the Division of Corporations. No articles, no Wyoming LLCs.

Here’s the breakdown:

- Online filing: $100 (quick and cheap)

- Mail filing: $102 (slower, costs a tad more)

- What it covers: Articles of Organization (LLC name, address, registered agent)

- Where to file: Wyoming Secretary of State – Division of Corporations

According to the Wyoming SOS, most folks file online to start an llc fast and save a couple bucks.

For example, if you launch “Sagebrush Ventures LLC,” you’d pay $100 online, submit your Wyoming LLC Articles of Organization, and be set to form a wyoming llc in days

What Does a Wyoming Registered Agent Cost Each Year

Every Wyoming limited liability company needs a registered agent on file. No agent, no good standing. You’ve got two ways. Do it yourself if you’re located in Wyoming, or hire a professional. The state allows either.

A DIY setup

A DIY setup means no additional cost, but you must keep a registered agent’s address open during business hours. Not always practical.

Professional Option

Professional help isn’t free, but it’s steady. Most charge \$50–\$300 a year. Services like Bussines Rocket often throw in the first year of registered agent service if you create your LLC through them. That’s handy, especially when you’re juggling the Wyoming Articles of Organization, an LLC annual report, and other costs associated with forming.

For Example. You set up “High Plains Outfitters.” You filed with the Wyoming Secretary, paid the fee payable to the Wyoming Secretary, and the provider covered your first year. Next year, you’ll pay an annual \$125 or so to stay covered. Clean, predictable.

It’s one of the reasons folks say Wyoming is the best state to form an LLC, easy process, clear costs, nothing messy hiding in the fine print.

Is paperwork slowing you down? We’ll handle the LLC setup, letting you focus on what matters growing your business with ease.

How Much Does It Cost to File the Annual Report and Stay in Good Standing

The Wyoming LLC annual report costs a minimum of $60, or $0.0002 per dollar of assets in Wyoming if you’ve got more valuable stuff, per 2025 rules. This filing, due on the first day of your LLC’s formed anniversary month, keeps every Wyoming LLC legit via the Annual Report Wizard. Skip it, and you’re risking penalties or losing your LLC in good standing.

Here’s the breakdown:

- Minimum cost: $60 annual fee

- Higher assets: 0.0002 × assets in wyoming (whichever’s higher)

- Applies to all: single-member llc, multi-member llc, or llc taxed as a corporation

According to the Wyoming SOS, wyoming requires this llc annual report to keep your wyoming llc formation active, whether you’re a single-member llc or an llc has more than one owner.

For example, if you form your wyoming llc called “Prairie Peak Co.,” got your ein for your llc via IRS, and picked a registered agent for service like Bussiness Rocket , you’d pay the annual fee llc online to keep your llc in good.

Are There Extra Fees for Articles of Organization, Amendments, or Name Changes

Setting up a Wy LLC starts simple: Articles of Organization cost \$100 online or \$102 by mail. After that, only changes trigger additional fees. Think of amendment filings, a new trade name, or a DBA. These are optional. As LLC University noted in its 2025 guide, clear costs let LLC owners plan smart when they form your Wyoming LLC today.

Articles of Organization

- Cost: $100 online, $102 mail

- Purpose: Registers your name in Wyoming and LLC members

- When: One-time, filed with the Secretary to form your LLC or corporation

Amendments

- Cost: $50 per amendment filing

- Purpose: Updates agent, address, or name

- When: Only if the LLC will operate under new details

Name Changes

- Cost: $60 for name reservation, $100 for a Wyoming DBA

- Purpose: Secures a new brand or business license in Wyoming

- Details: Comes with plus state fees, but protects your identity

Tip: many use an LLC formation service like Business Rocket for filings. They handle the paperwork and help you stay compliant.

What Does It Cost to Register a Foreign LLC in Wyoming

First, you need someone in Wyoming to handle your legal mail and state notices, ensuring your llc formed elsewhere stays compliant. The foreign LLC registration fee is $150 in 2025 for a Wyoming certificate of authority, plus yearly costs to keep your interstate business legit. It’s a cheap way to expand, and wyoming is the best state for low fees.

Here’s the breakdown:

- Registration Fee: $150 for Wyoming certificate of authority

- Annual Report: $60 minimum (or 0.0002 × assets, wyoming annual fee)

- Agent Service: $50–$300/year for service in wyoming

- When to File: Before your llc will operate in Wyoming

According to the Wyoming SOS, a foreign LLC is your out-of-state llc formed doing interstate business here, like sales or an office. The cost to start a wyoming operation is low, with a 2025 Wyoming Business Council report highlighting affordable expansion.

Pay for only what you need, get your Wyoming LLC active in record time!

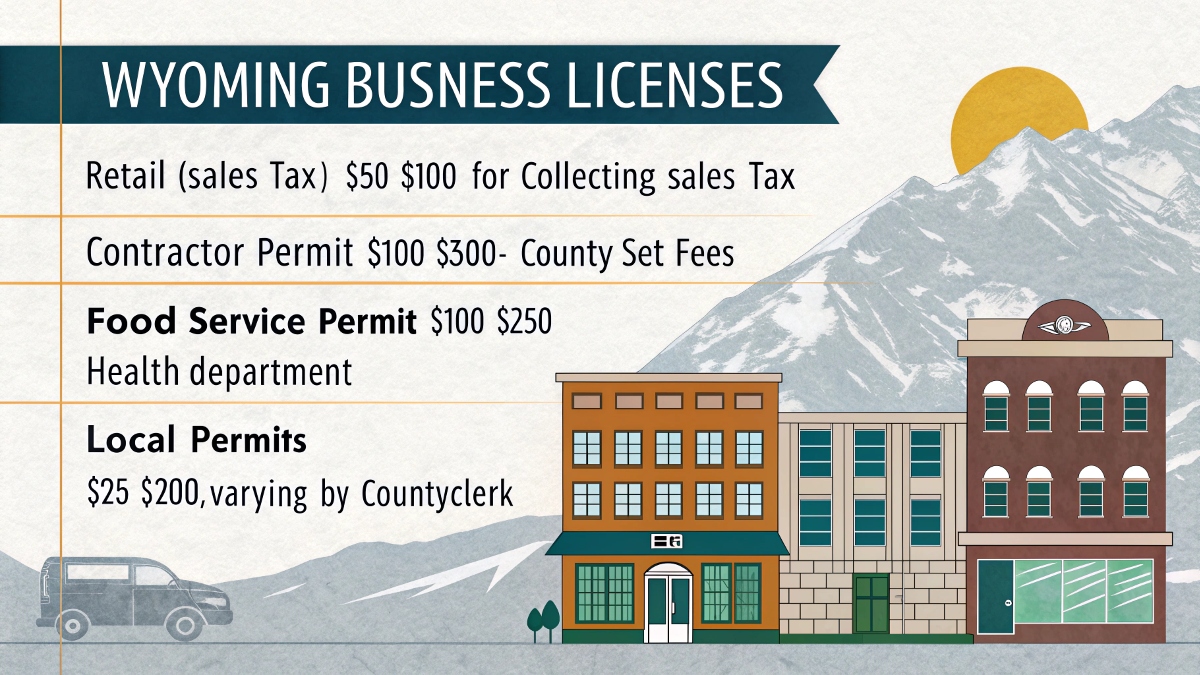

What Extra Costs Come With Wyoming Business Licenses and Permits

Wyoming skips a general Wyoming business license, but your llc must get professional permits for certain industries, costing $50–$300+ in 2025, per local county clerk rules.

According to Wyoming SOS, about 60% of businesses need permits like a sales tax license. A 2025 LLC University guide says low fees make wyoming llc taxes simple. Wyoming also lets you elect to have your llc taxed flexibly via IRS.

| Permit Type | Cost | Details |

|---|---|---|

| Retail (Sales Tax License) | $50–$100 | For collecting sales tax |

| Contractor Permit | $100–$300+ | Construction, county-set |

| Food Service Permit | $100–$250 | Restaurants, health dept |

| Local Permits | $25–$200 | Varies by county clerk |

Quick Tip: Contact your county clerk early to confirm permit needs with Business Rocket for apply to your llc, saving cash.

How Do Wyoming LLC Costs Compare With Other States

Wyoming’s $100 filing fee and no franchise tax make it the cheapest LLC state, with killer privacy to boot. Compare that to Delaware, Nevada, California, and Texas, and you’ll see why Wyoming shines for apply to your llc cost savings.

According to Wyoming SOS, wyoming llc taxes are minimal, per IRS. A 2025 LLC University guide says Wyoming’s low fees and anonymity beat most states.

| State | Filing Fee | Annual Fee/Tax | Privacy |

|---|---|---|---|

| Wyoming | $100 | $60+ (asset-based) | High (anonymous) |

| Delaware | $90 | $300 franchise tax | Moderate |

| Nevada | $75 | $500 license + $150 report | High |

| California | $70 | $800 min tax | Low |

| Texas | $300 | $0–$200 franchise | Low |

Wyoming stands out because it keeps startup and ongoing costs low while giving you something money can’t usually buy, privacy. If you’re weighing where to form, it’s hard to ignore the numbers.

FAQs

How much does it cost to start an LLC in Wyoming in 2025?

It’s $100 online or $102 by mail to file. Add $50–$300 yearly for an agent. A 2025 LLC University guide praises Wyoming’s low startup costs. File via Wyoming SOS to keep it cheap.

Does Wyoming charge an annual fee for LLCs?

Yes, you pay a $60 minimum annual report fee. It’s higher if assets exceed $300,000 (0.0002 × value). A Wyoming Business Council report highlights affordability. File by your anniversary month to stay compliant.

Is there a franchise tax for Wyoming LLCs?

Nope, Wyoming skips franchise tax, unlike other states. This cuts wyoming llc taxes significantly. Check IRS for federal tax rules. A 2025 LLC University guide notes big savings.

What is the cheapest way to form a Wyoming LLC?

File online for $100 and be your own agent. This slashes cost to start a wyoming LLC. LLC University says DIY saves 30% for startups. Ensure you handle legal notices correctly.

How much does a Wyoming registered agent cost per year?

Expect $50–$300 annually for agent services. BusinessRocket offers reliable options. A 2025 Wyoming Business Council report emphasizes privacy perks. Your llc must have one for compliance.

Are there hidden fees when forming a Wyoming LLC?

No hidden costs; filing is $100, permits optional ($50–$300). Wyoming also avoids surprise taxes. A 2025 LLC University guide ensures fee transparency. Plan for annual reports to stay safe.

Do I need a business license for my Wyoming LLC?

Some industries need permits ($50–$300+), not a state license. About 60% require one, per local rules. Check with your county clerk to confirm. This may apply to your llc.

How much does it cost to maintain a Wyoming LLC compared to Delaware or Nevada?

Wyoming’s $60+ annual fee beats Delaware LLC cost ($300) and Nevada LLC fees ($500+). No franchise tax saves cash. LLC University calls it the cheapest LLC state.

Can I form a Wyoming LLC without living in Wyoming?

Yes, non-residents pay $100 to file. You need a Wyoming agent for notices. A Wyoming Business Council report touts ease for outsiders. Use an agent service for smooth setup.

What is the total cost to keep a Wyoming LLC in good standing?

Annual report ($60+) plus agent ($50–$300) are key. No state taxes keep wyoming llc taxes low. Elect to have your llc taxed per IRS. File yearly to stay legit.

Related Article About LLC

- Illinois Business Search in 2025 – Check Name Availability November 16, 2025 - Home » Cost Of LLC in WyomingIllinois Business Entity Search in 2025 Visit www.ilsos.gov for Illinois business search to check the availability of an LLC name and other entity types, and enter your desired name in the search bar. Fastest National Processing Times! REGISTER AN LLC The Illinois Business Search is the state’s official tool …

Illinois Business Search in 2025 – Check Name Availability Read More »

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Cost Of LLC in WyomingMaryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide Step …

Maryland Business Name Search – Check Name Availability November 11, 2025 - Home » Cost Of LLC in WyomingMaryland Business Entity Search Use the Department of Assessments and Taxation (SDAT) Maryland business entity search tool to check name availability and ensure your desired business name isn’t already registered in MD. Fastest National Processing Times! REGISTER AN LLC Table of Contents Maryland Business Entity Search Step-by-Step Guide Step …Maryland Business Name Search – Check Name Availability Read More »

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Cost Of LLC in WyomingOhio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, and …

Ohio Business Entity Search – Check Name Availability November 10, 2025 - Home » Cost Of LLC in WyomingOhio Business Entity Search The Ohio Business Entity Search is the official online tool from the Ohio Secretary of State’s Office that lets anyone look up a company registered in the State of Ohio. Fastest National Processing Times! REGISTER AN LLC You can view filings, formation dates, agent details, and …Ohio Business Entity Search – Check Name Availability Read More »